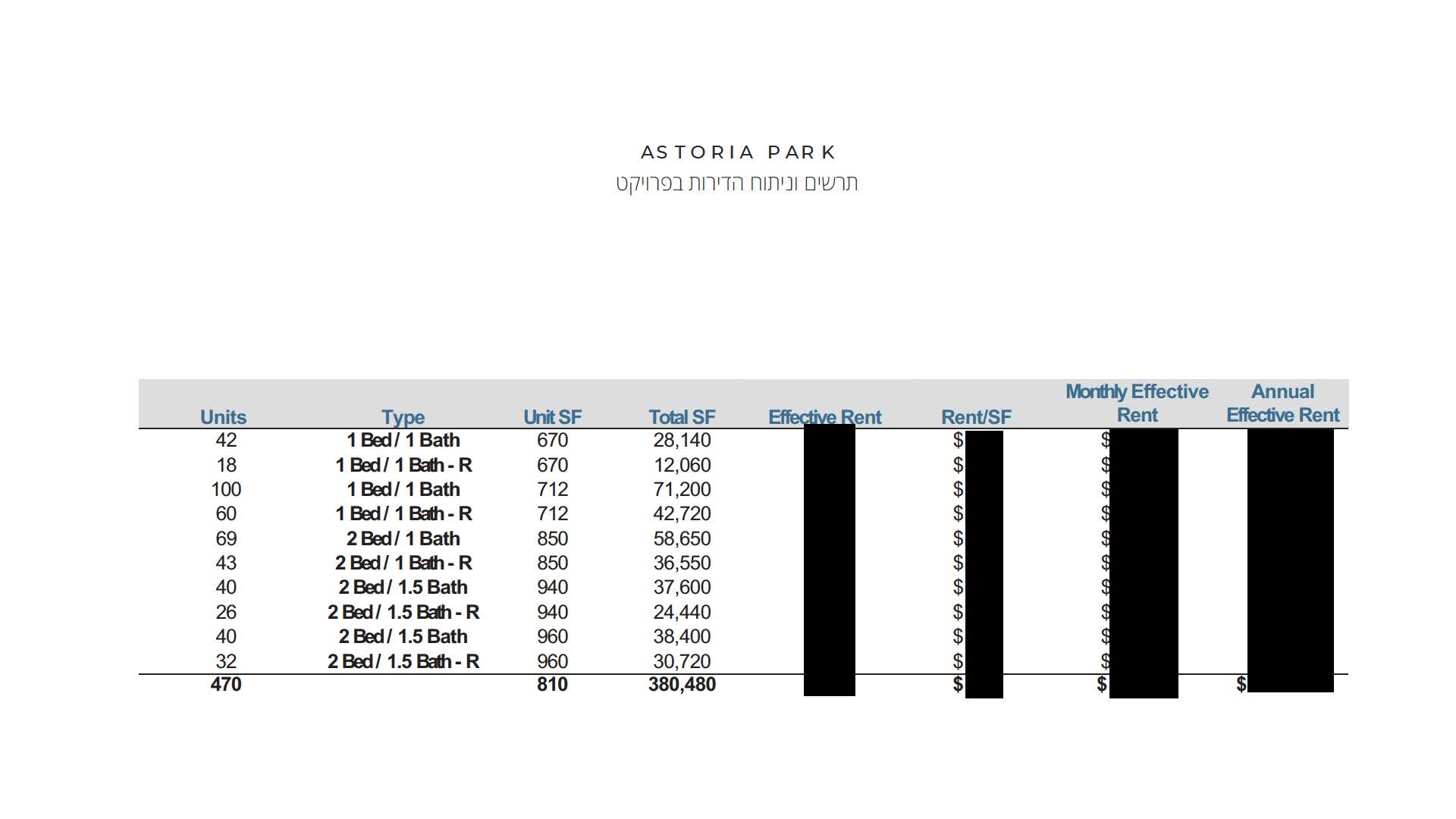

470 Units, Astoria Park, Indianapolis

Overview

- Apartment, Community, Condo, Multi Family Property

- 470

Description

Property Updated on Monday, September 12, 2022 by Lior Lustig

The summary of the investment:

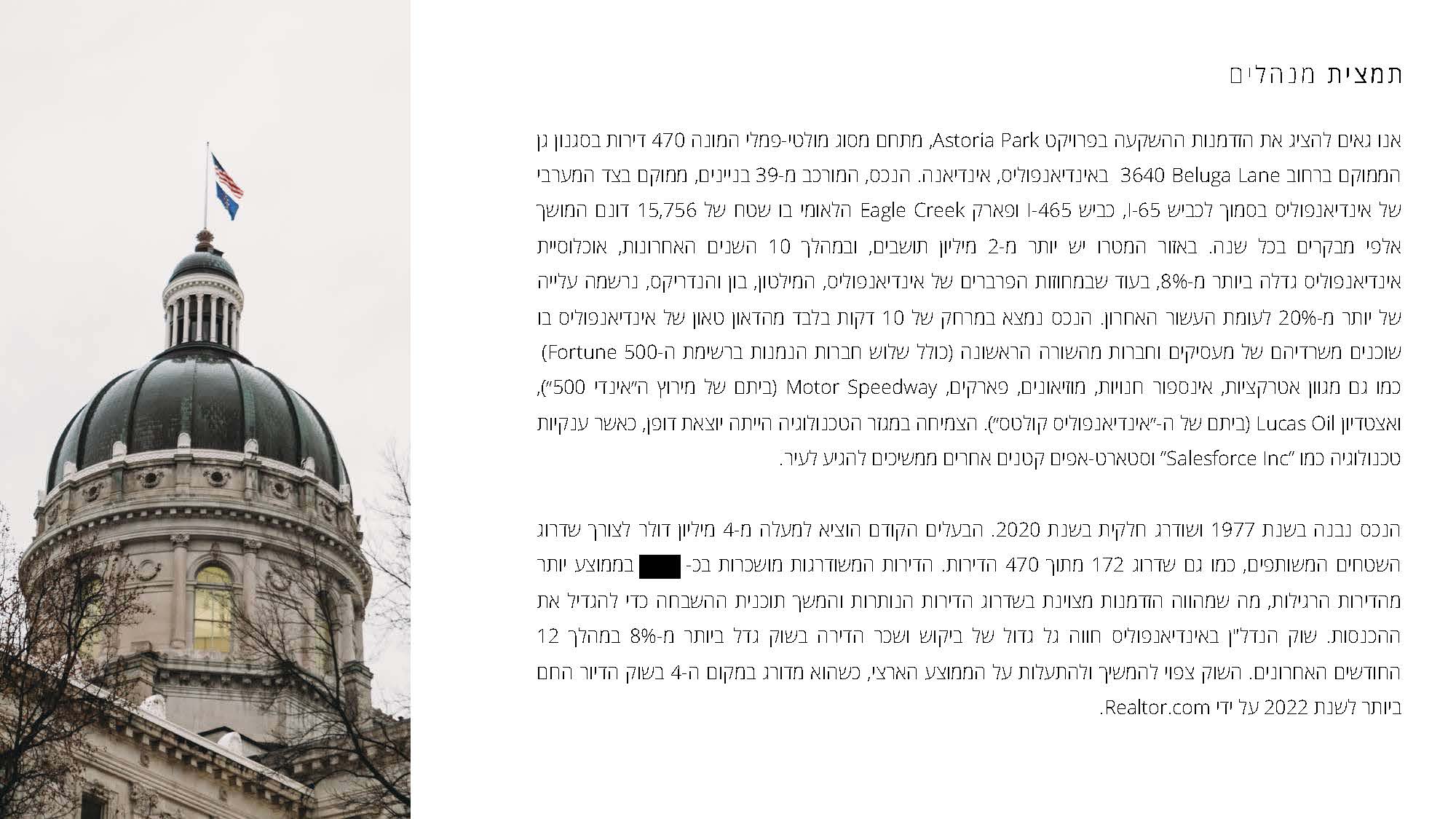

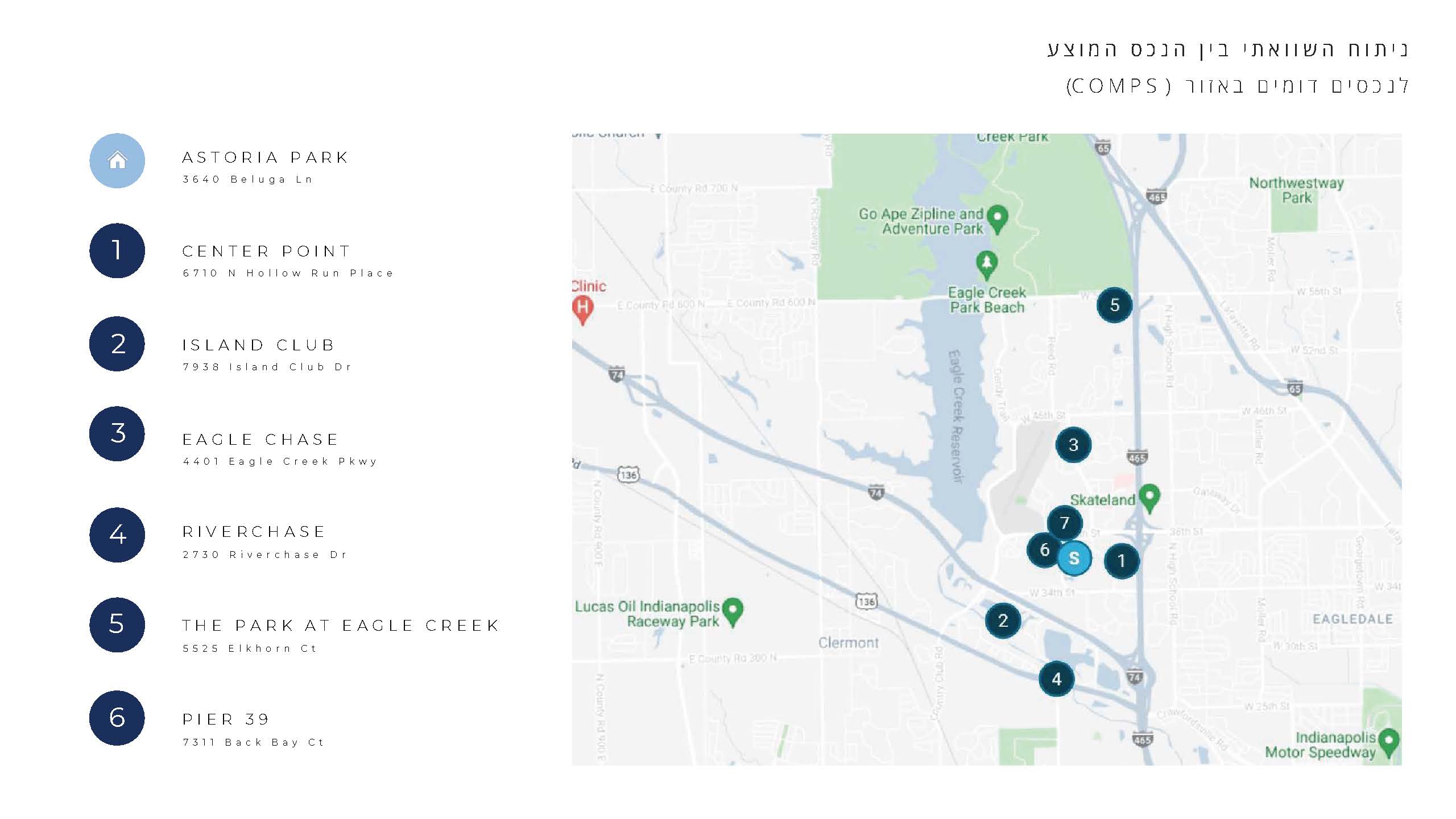

Nadlan Invest We are proud to present the investment opportunity in the Astoria Park project, a 470-unit garden-style multifamily complex located at 3640 Beluga Lane in Indianapolis, Indiana. The 39-building property is located on the west side of Indianapolis near I-65, I-465 and the 15,756-acre Eagle Creek State Park that attracts thousands of visitors each year. The metro area has more than 2 million residents, and over the past 10 years, the population of Indianapolis has grown by more than 8%, while the suburban counties of Indianapolis, Hamilton, Boone and Hendricks have seen increases of more than 20% over the past decade. The property is only 10 minutes away from downtown Indianapolis where the offices of top employers and companies are located (including three Fortune 500 companies) as well as a variety of attractions, countless shops, museums, parks, Motor Speedway (home of the Indy 500"), and Lucas Oil Stadium (home of the "Indianapolis Colts"). The growth in the tech sector has been extraordinary, with tech giants like Salesforce Inc and other small startups continuing to come to town.

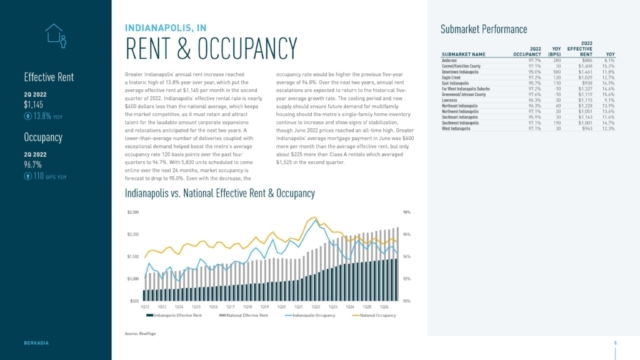

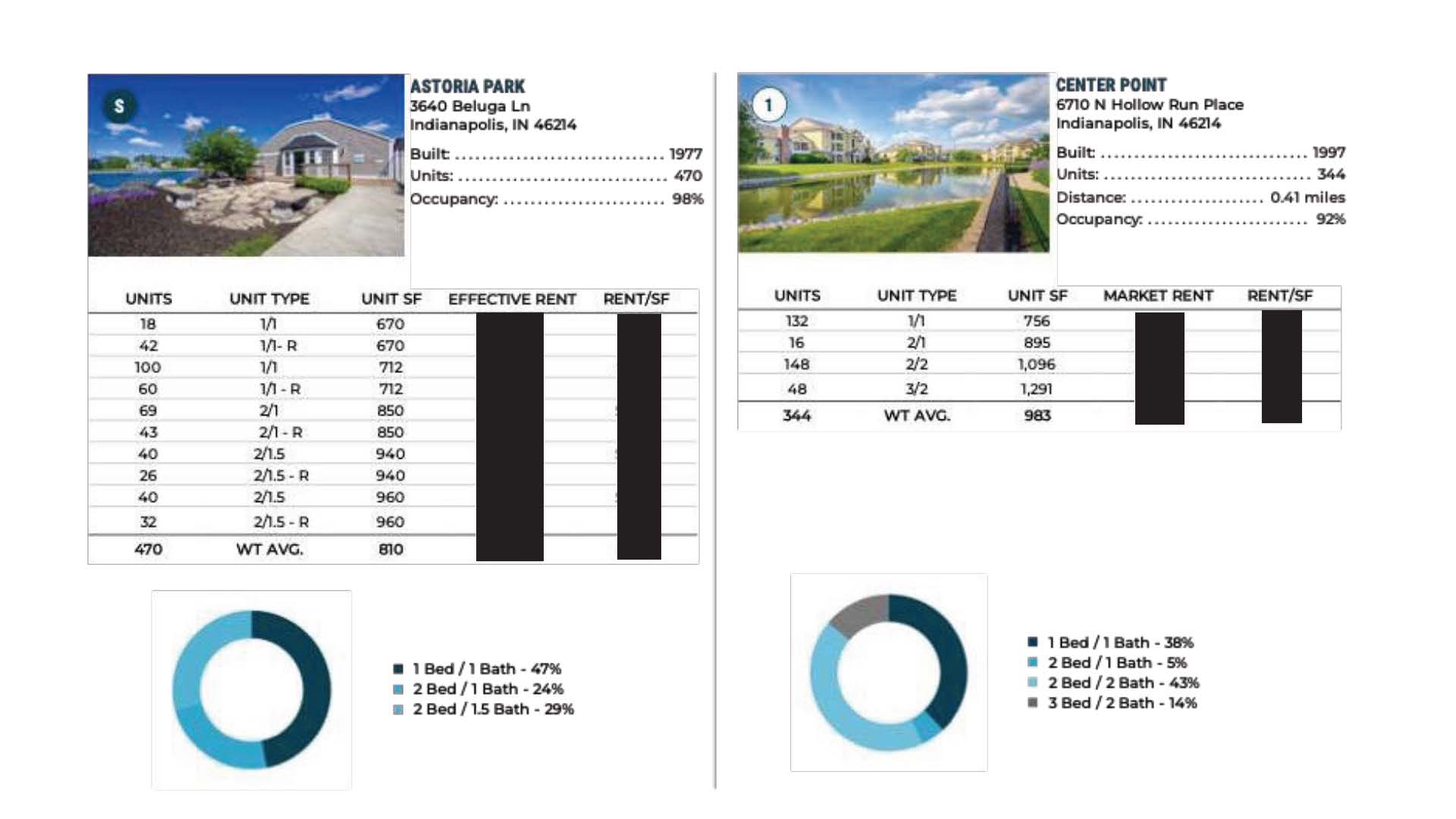

The property was built in 1977 and was partially upgraded in 2020. The previous owner spent over X million dollars to upgrade the common areas, as well as upgrade 172 of the 470 apartments. The upgraded apartments rent for about $XXX on average more than the regular apartments, which is a great opportunity to upgrade the remaining apartments and continue the improvement program to increase revenue. The real estate market in Indianapolis is experiencing a large wave of demand and rents in the market have increased by more than 8% over the past 12 months. The market is expected to continue to outperform the national average, being ranked 4th in the hottest housing market for 2022 by Realtor.com.

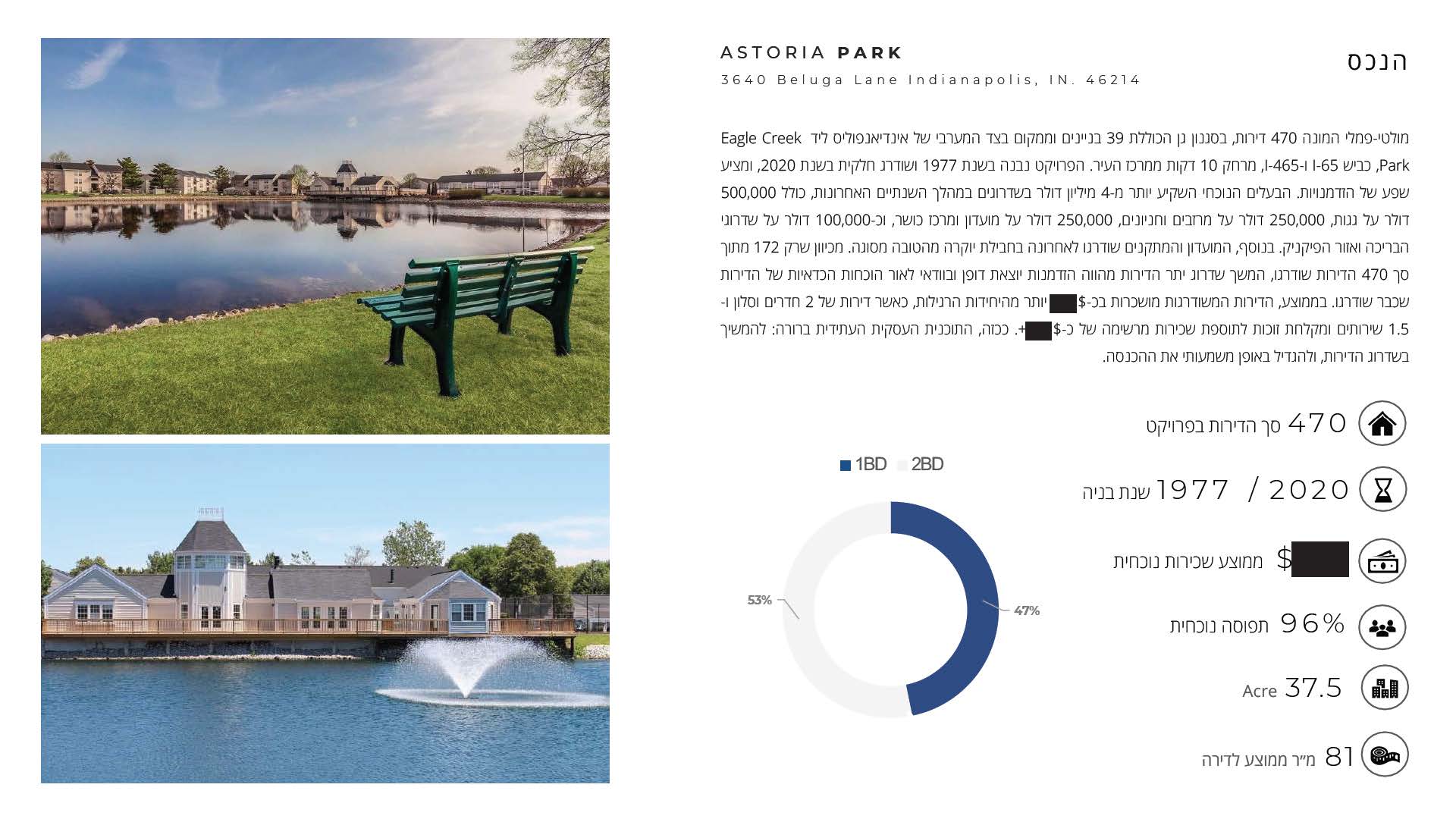

Property:

A 470-unit, garden-style multifamily with 39 buildings and a location on the west side of Indianapolis near Eagle Creek Park, I-65 and I-465, 10 minutes from downtown. The project was built in 1977 and partially upgraded in 2020, offering plenty of opportunities. The current owner has invested more than $4 million in upgrades over the past two years, including $500,000 on roofs, $250,000 on gutters and parking lots, $250,000 on a clubhouse and fitness center, and about $100,000 on pool and picnic area upgrades. In addition, the club and facilities were recently upgraded with a best-in-class luxury package. Since only 172 of the total 470 apartments have been upgraded, continuing to upgrade the rest of the apartments is an extraordinary opportunity and certainly in light of the proof of the viability of the apartments that have already been upgraded. On average, the upgraded apartments are rented for about $XXX more than the regular units, where apartments with 2 rooms and a living room and 1.5 bathrooms and a shower receive an impressive rental increase of about $XXX+. As such, the future business plan is clear: to continue upgrading the apartments, and significantly increase the income.

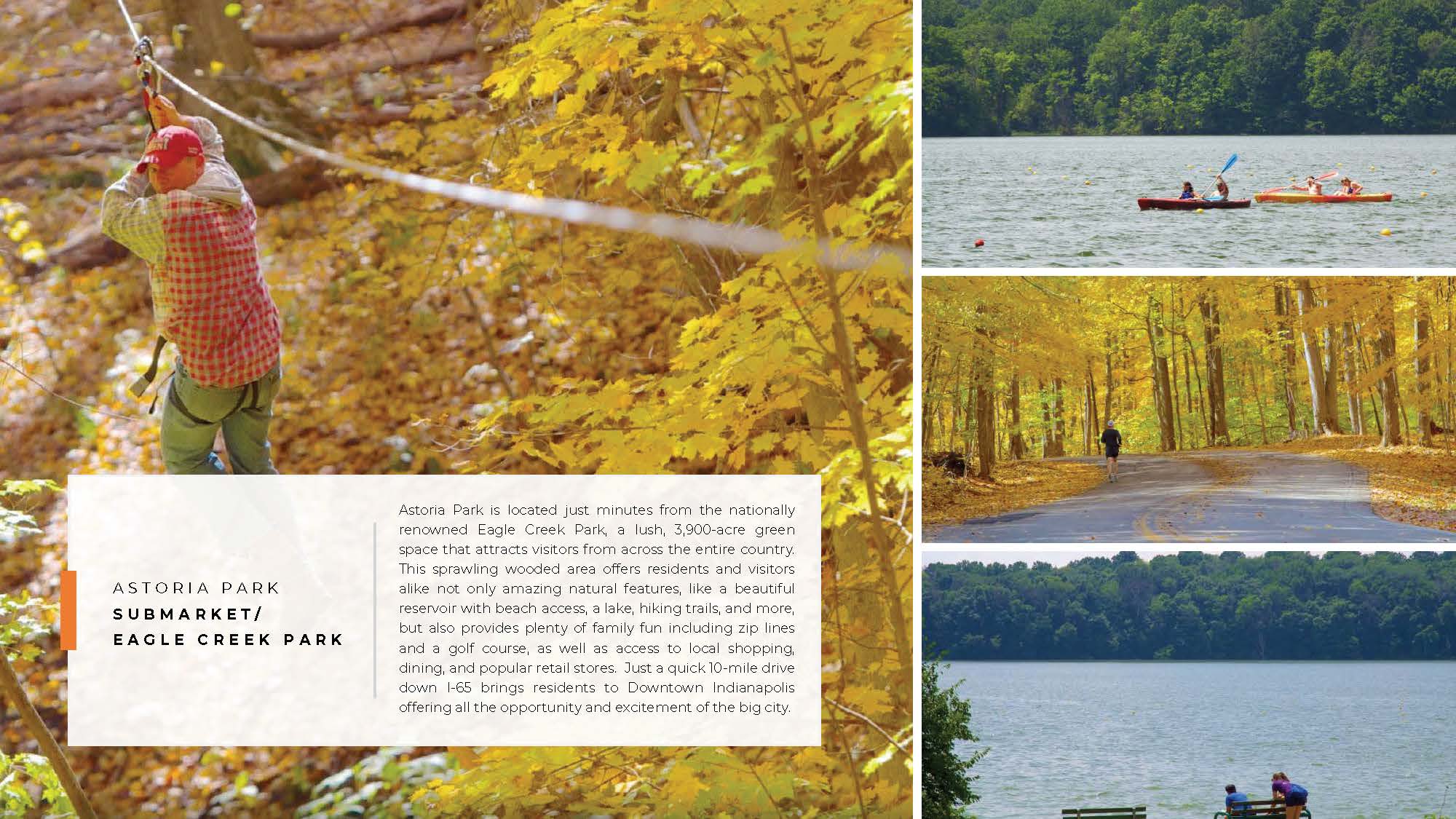

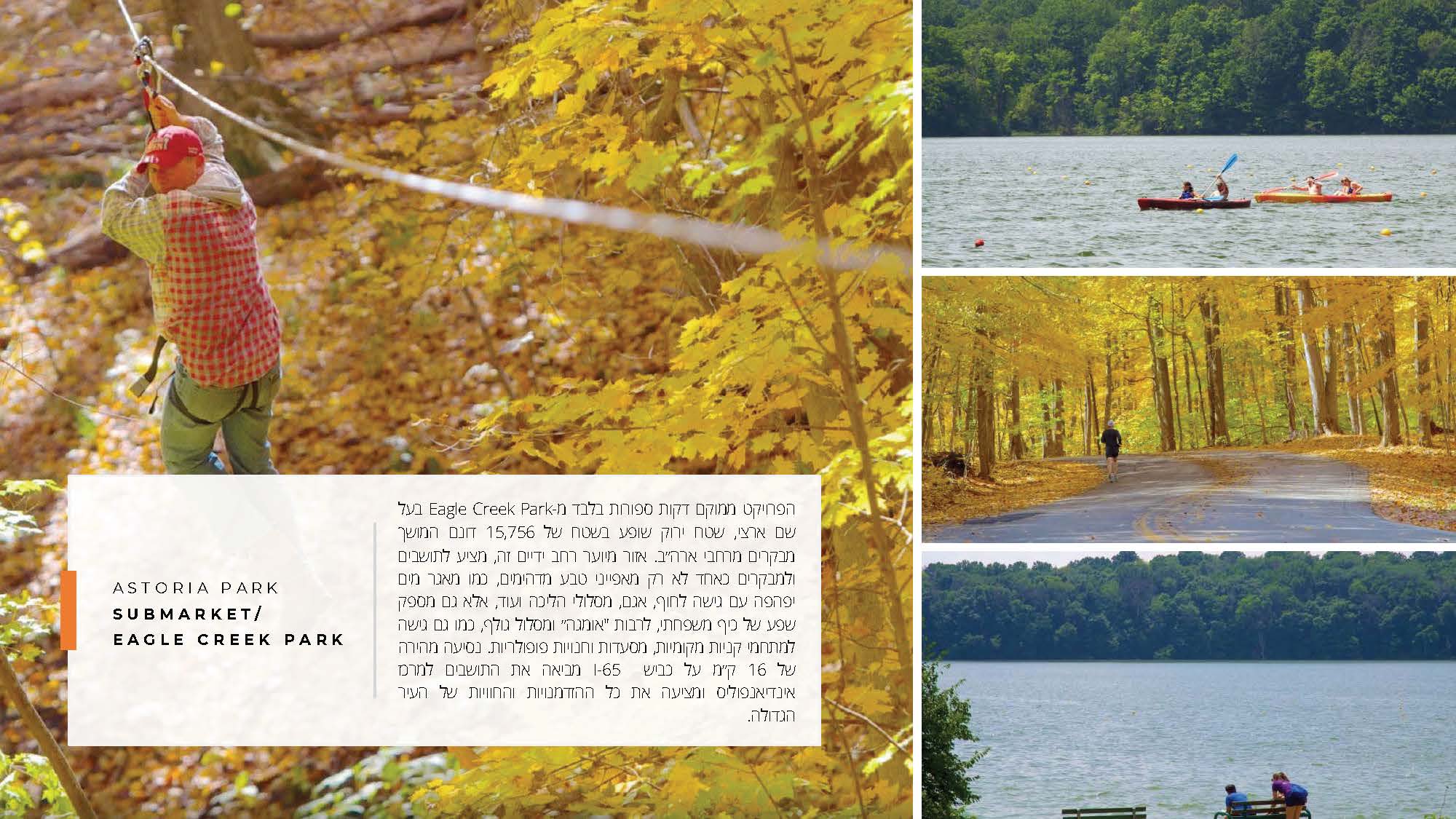

Eagle Park:

The project is located just minutes from nationally renowned Eagle Creek Park, a 15,756-acre lush green space that attracts visitors from across the United States. This sprawling wooded area offers residents and visitors alike not only amazing natural features, such as a beautiful reservoir with access to the beach, a lake, hiking trails, and more, but also provides plenty of family fun, including an "Omega" and golf course, as well as access to shopping complexes. Local, popular restaurants and shops. A quick 16 mile drive on I-65 brings residents to downtown Indianapolis and offers all the opportunities and experiences of the big city.

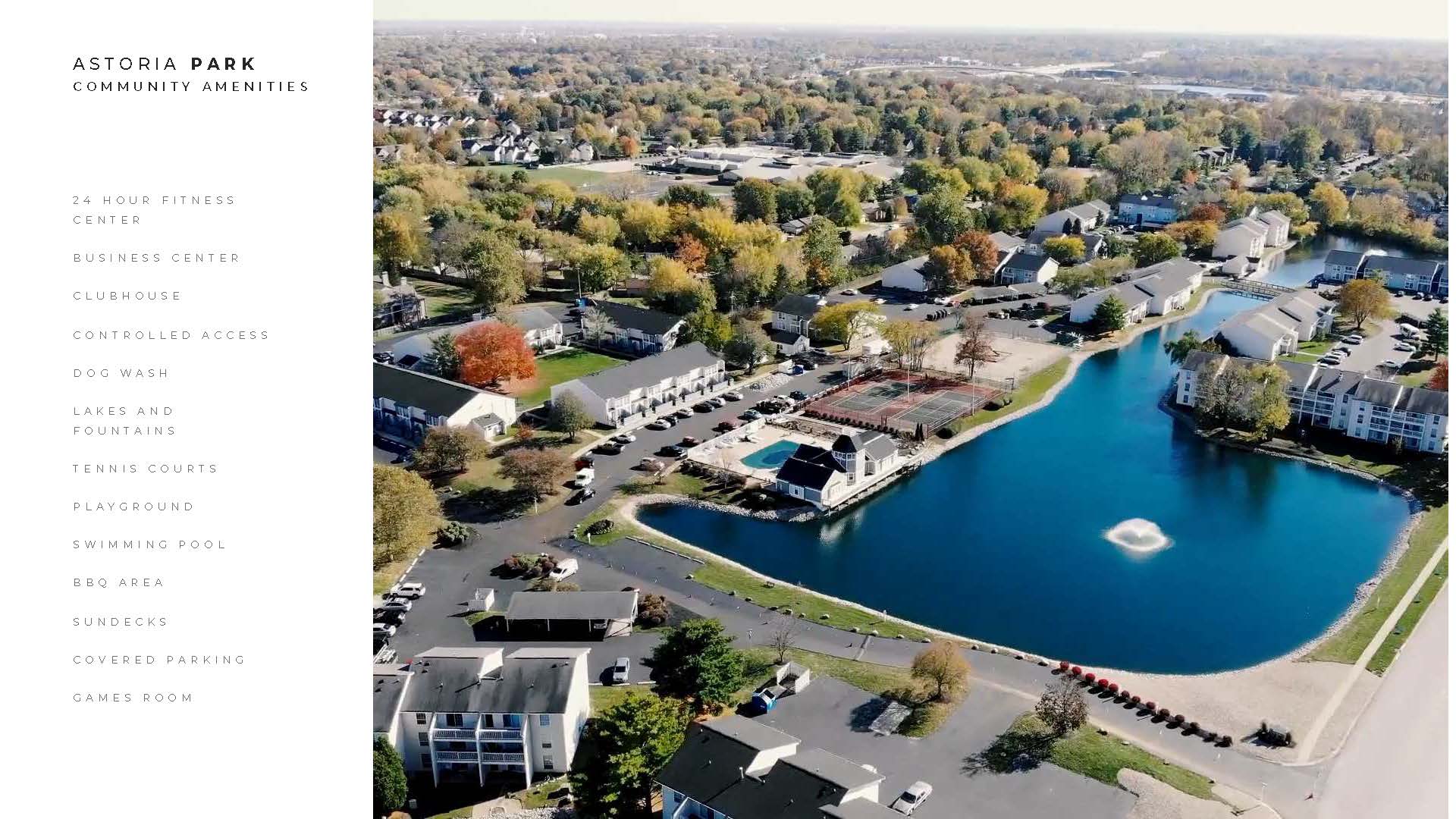

An aerial view of the Astoria Park project:

The benefits of investing in multi-family during times of crisis - lecture from a conference Nadlan Expo:

Lior Lustig's lecture on the benefits of investing in Multi Family:

Lecture on the Astoria project at the Nadlan Expo 2022 conference:

Complex services:

Gym open 24/7

Business Lounge

Tenants club

controlled access

dog park

lakes and fountains

Tennis Court

Playground

A swimming pool

Barbecue complex

Covered parking lots

Game room

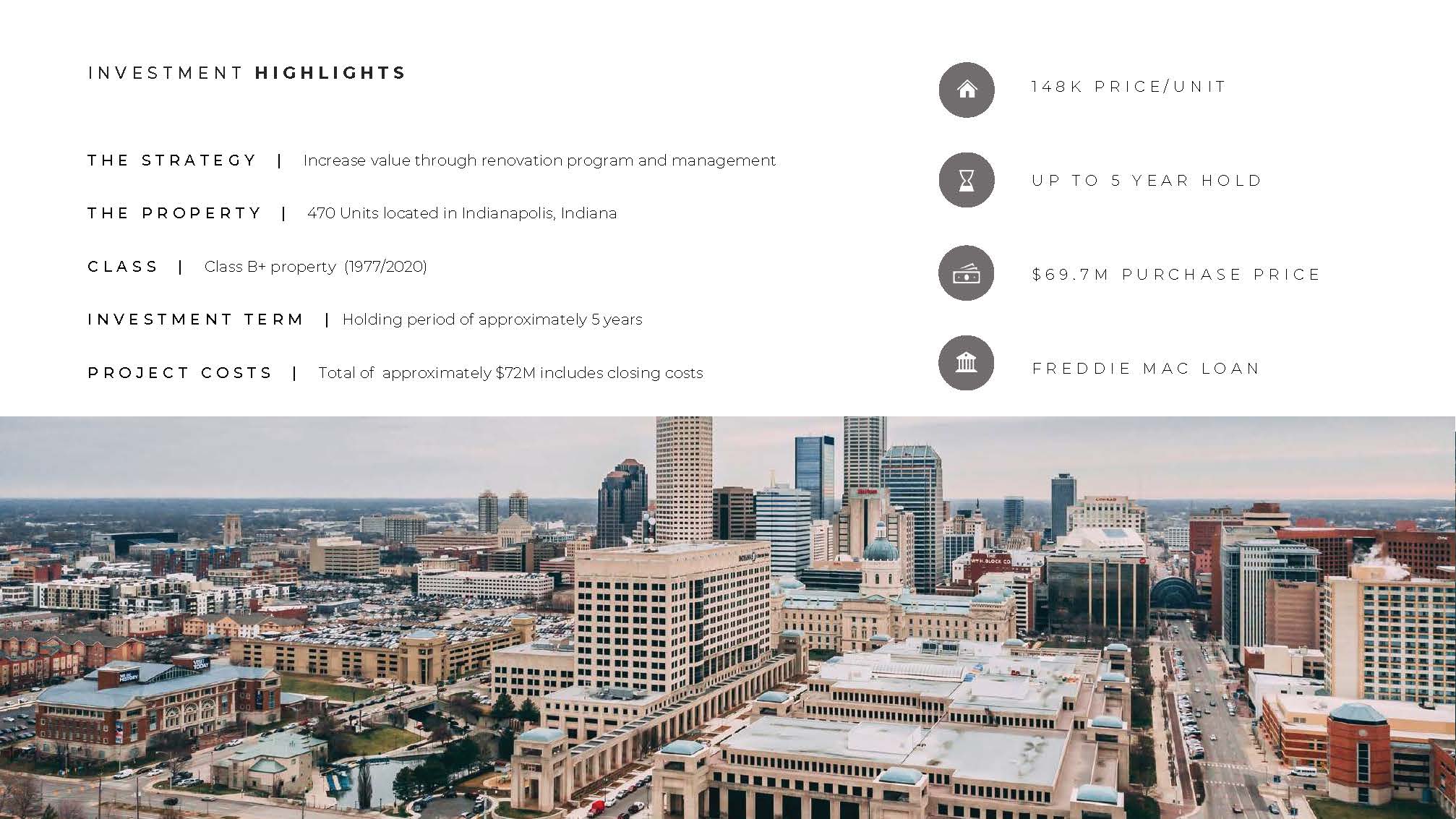

The main aspects of the investment:

The investment Purchase, improvement and sale after re-stabilization of the property

the assets | 470 apartments located in Indianapolis, Indiana

Asset rating Blue collar workers, B+ rating (1977/2022)

The investment period 3 to 5 years

Project costs A total of about XX million dollars including purchase expenses

xxxK average price per apartment

Investment time range 3-5 years

Purchase price xx.x$

FREDDIE MAC LOAN A lending bank

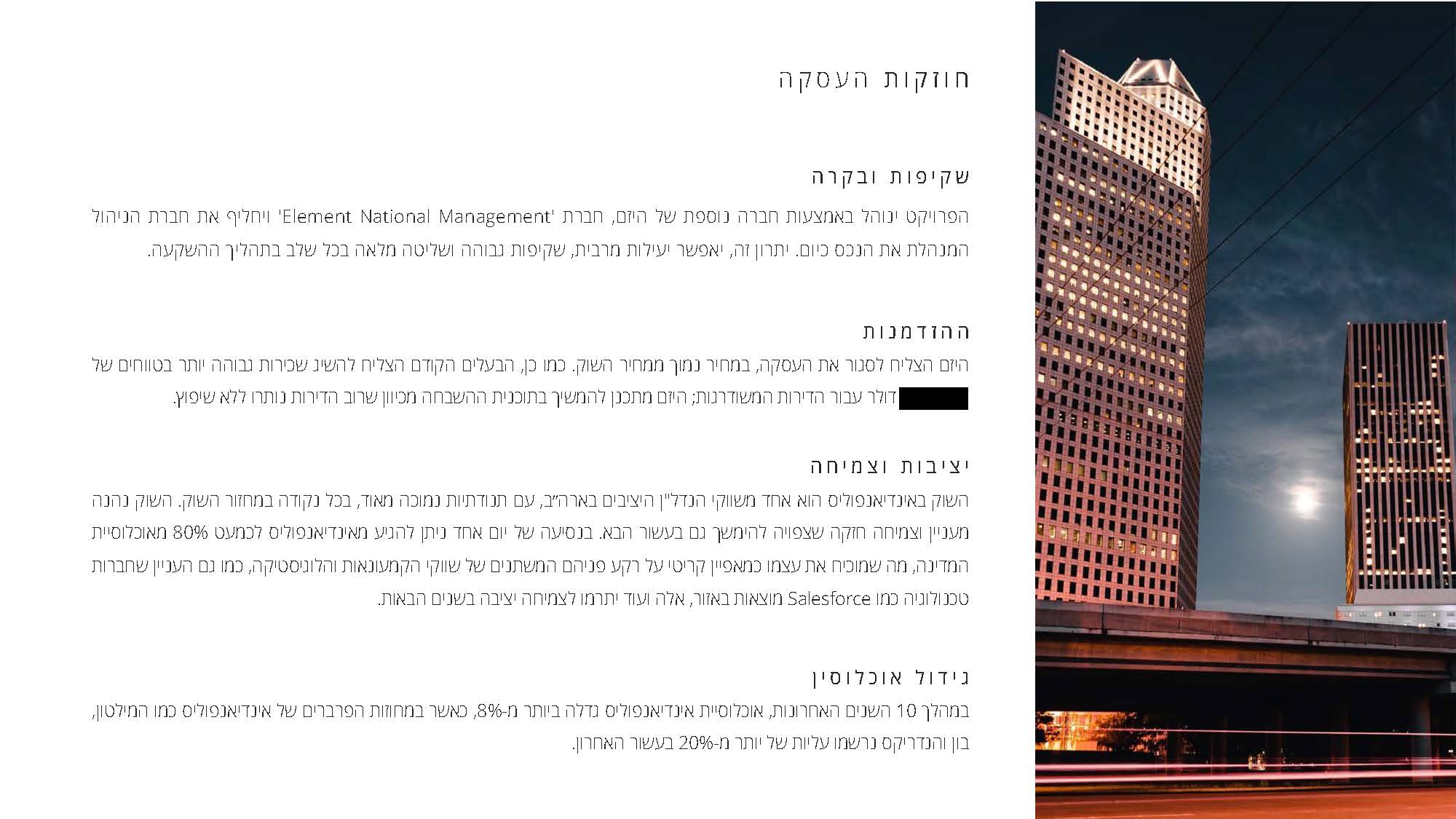

Strengths of the deal:

Transparency and control

The project will be managed through another company of the developer, Element National Management, and will replace the management company that currently manages the property. This advantage will allow maximum efficiency, high transparency and full control at every stage of the investment process.

Opportunity

The entrepreneur managed to close the deal, at a price lower than the market price. Also, the previous owner was able to obtain higher rents in the ranges of $150-225 for the upgraded apartments; The developer plans to continue the improvement program because most of the apartments remain unrenovated.

stability and growth

The market in Indianapolis is one of the stable real estate markets in the US, with very low volatility, at any point in the market cycle. The market enjoys interest and strong growth that is expected to continue in the next decade as well. Almost 80% of the country's population can be reached from Indianapolis in one day's drive, which proves to be a critical feature in light of the changing face of the retail and logistics markets, as well as the interest that technology companies such as Salesforce find in the region, these and more will contribute to stable growth in the years to come.

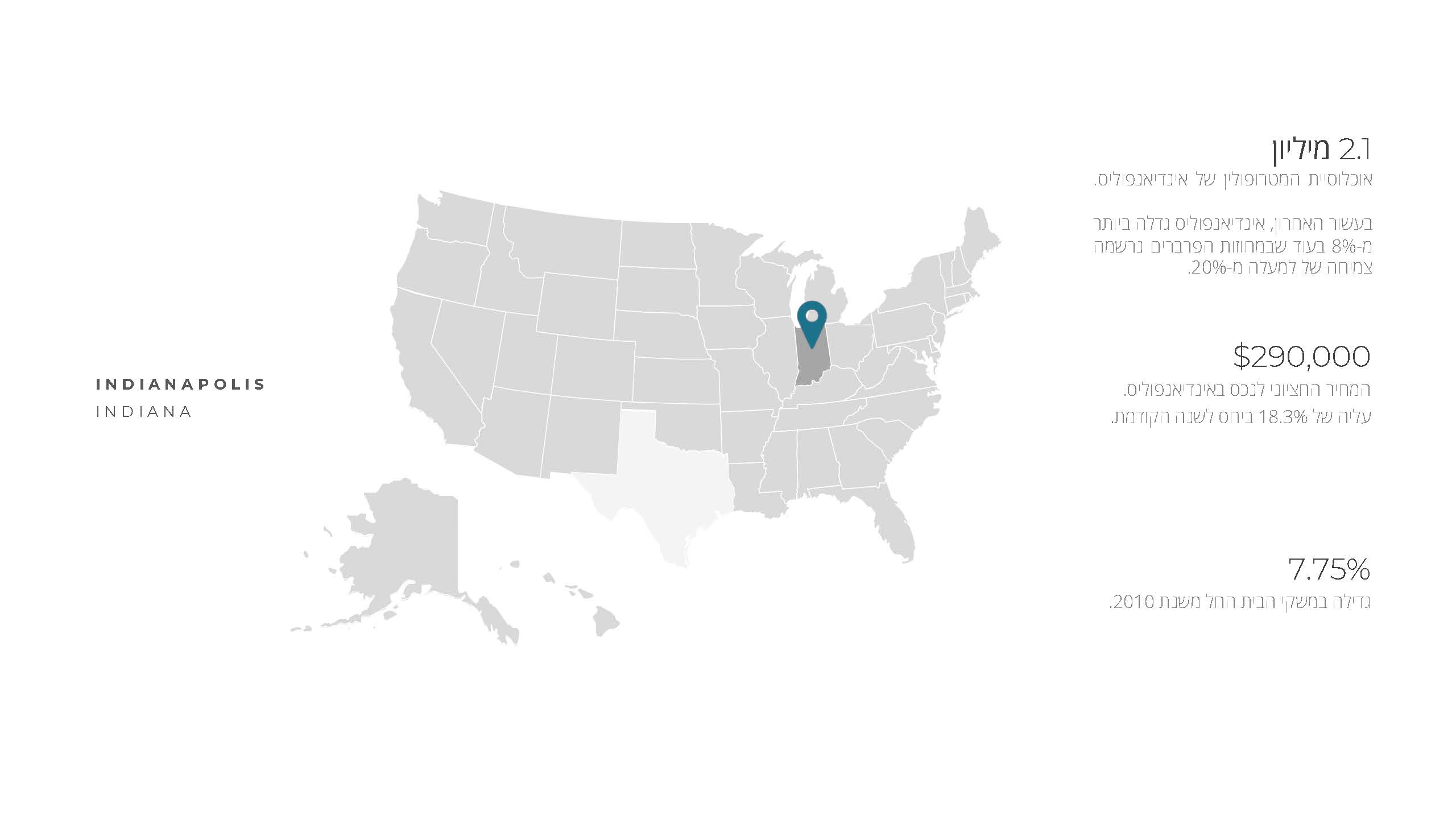

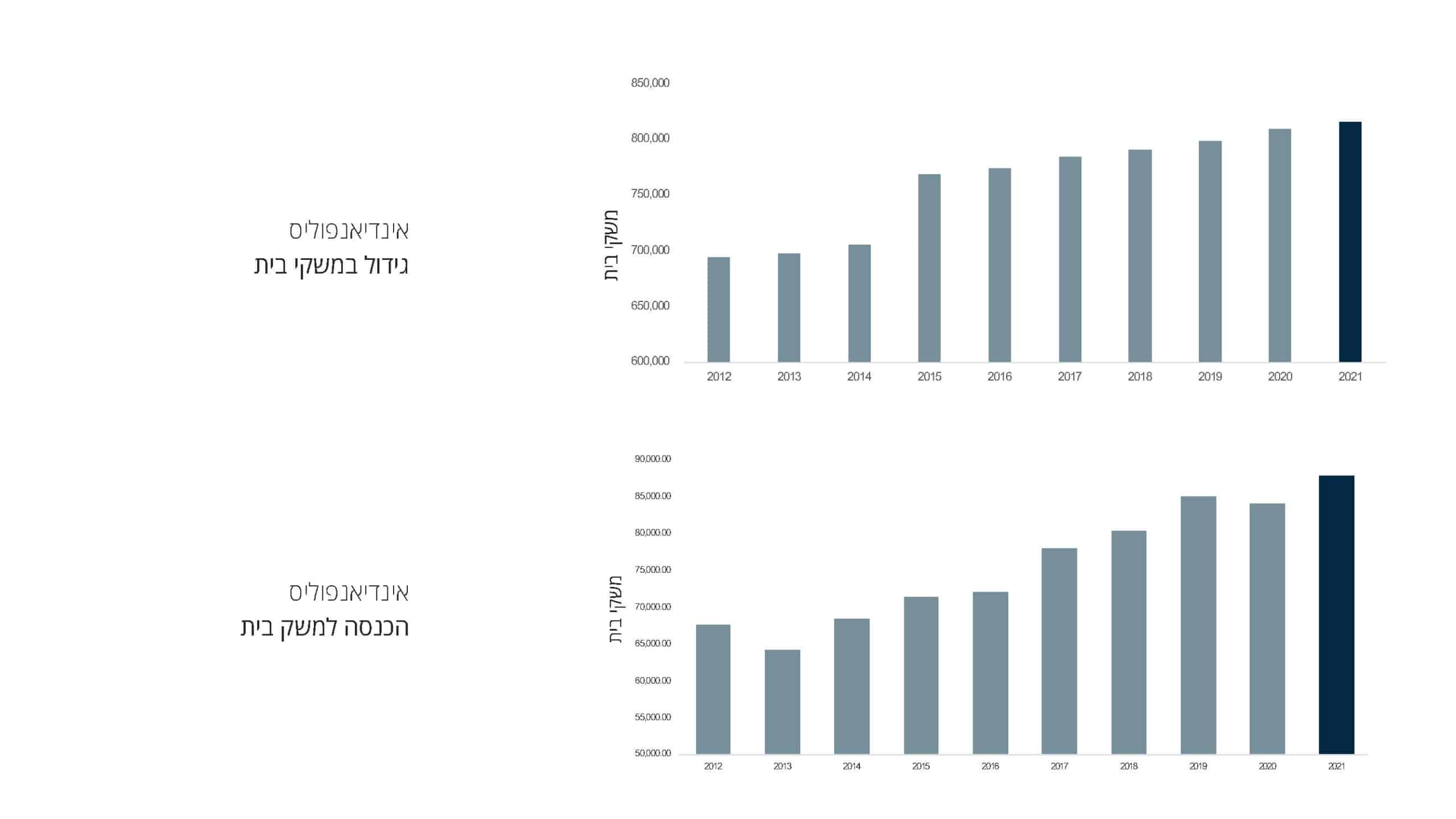

population growth

Over the past 10 years, Indianapolis' population has grown by more than 8%, with suburban Indianapolis districts such as Hamilton, Boone and Hendricks seeing increases of more than 20% over the past decade.

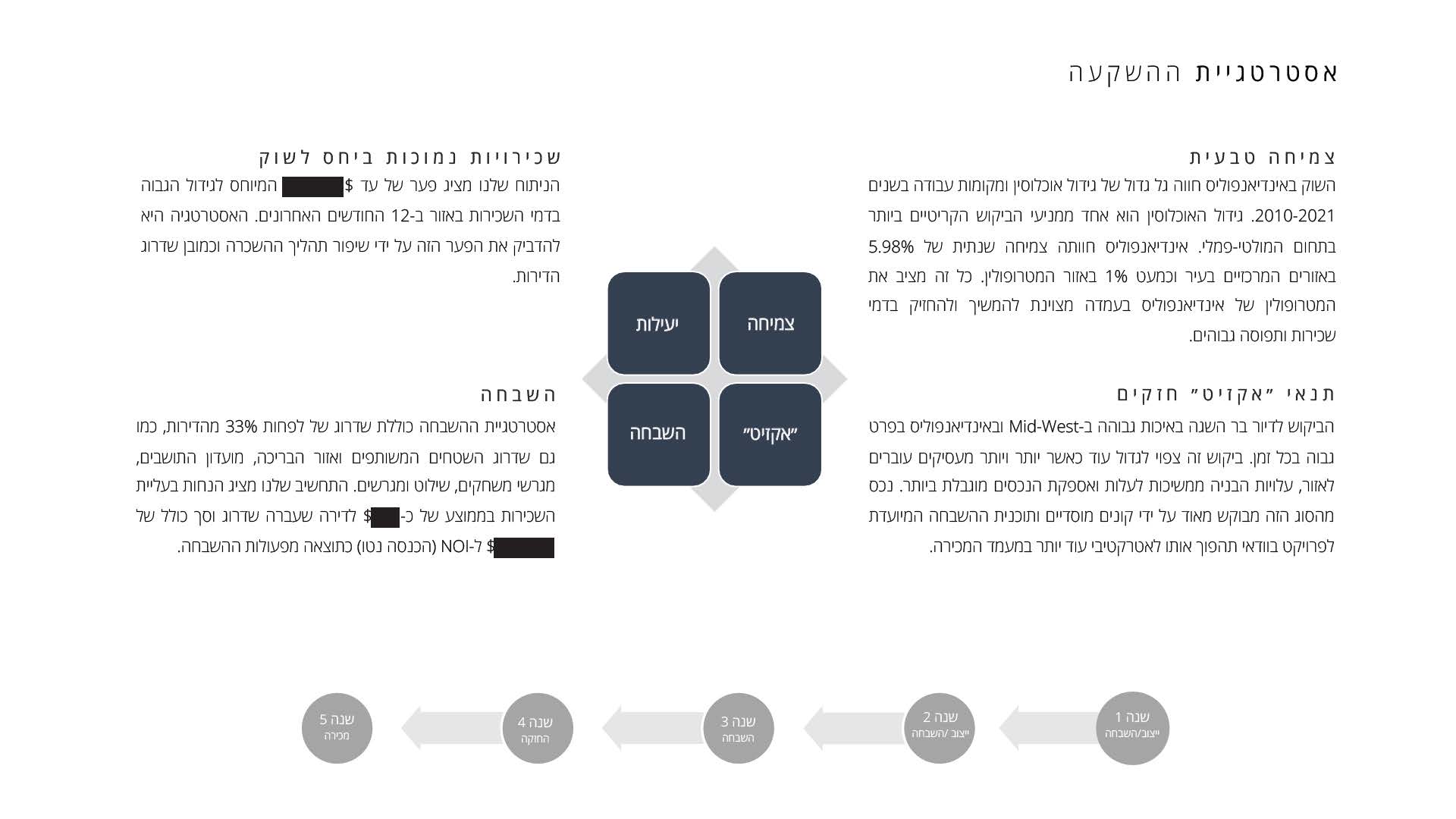

The investment strategy:

natural growth

The Indianapolis market is experiencing a major wave of population and job growth in 2010-2021. Population growth is one of the most critical demand drivers in the multi-family sector. Indianapolis experienced annual growth of 5.98% in the central areas of the city and almost 1% in the metropolitan area. All of this puts the Indianapolis metropolitan area in a great position to continue to hold high rents and occupancy.

Strong "exit" conditions

The demand for high quality affordable housing in the Mid-West and Indianapolis in particular is at an all time high. This demand is expected to grow further as more and more employers move to the area, construction costs continue to rise and the supply of properties is extremely limited. A property of this type is highly sought after by institutional buyers and the improvement plan intended for the project will surely make it even more attractive at the sale stage.

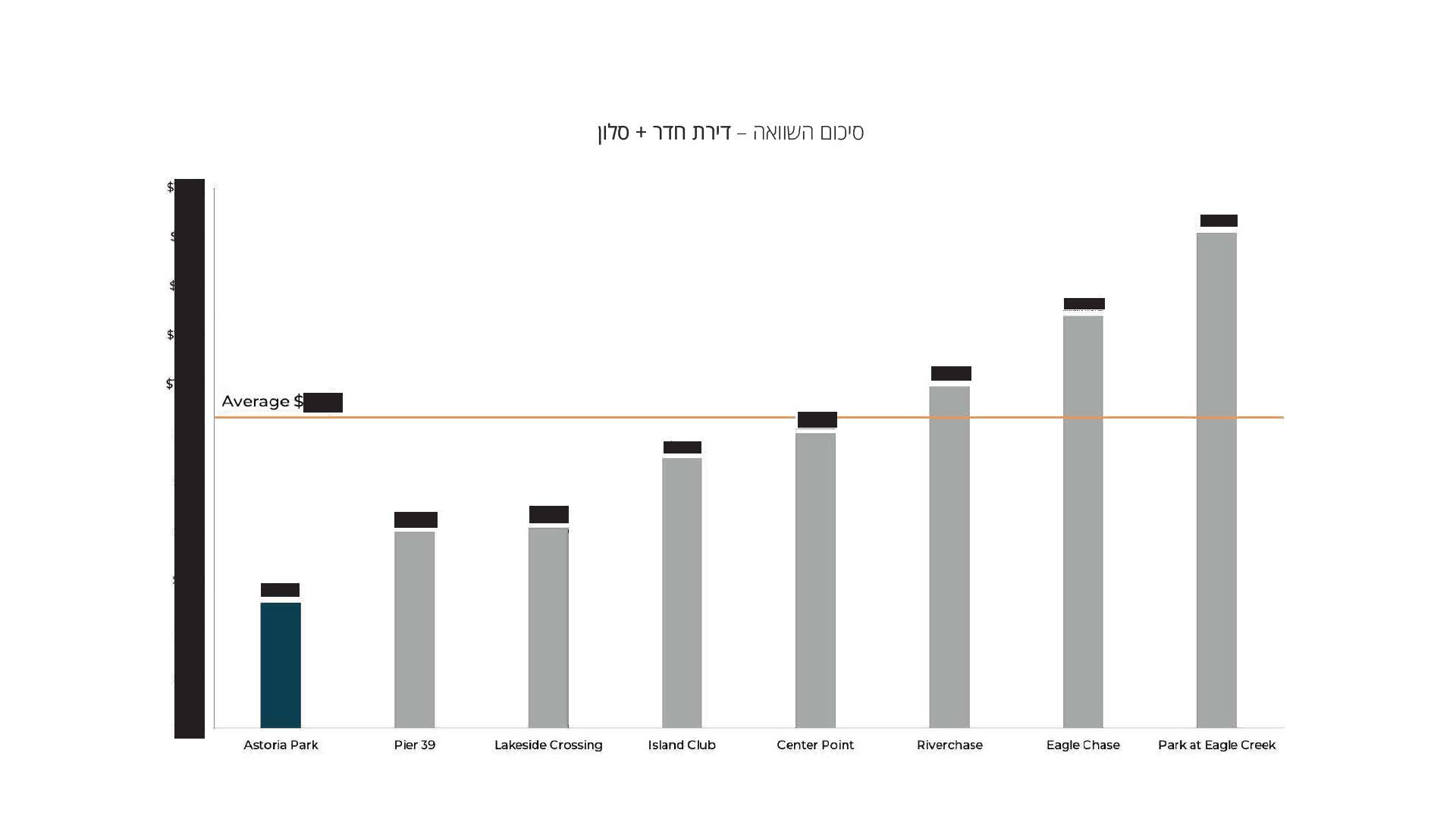

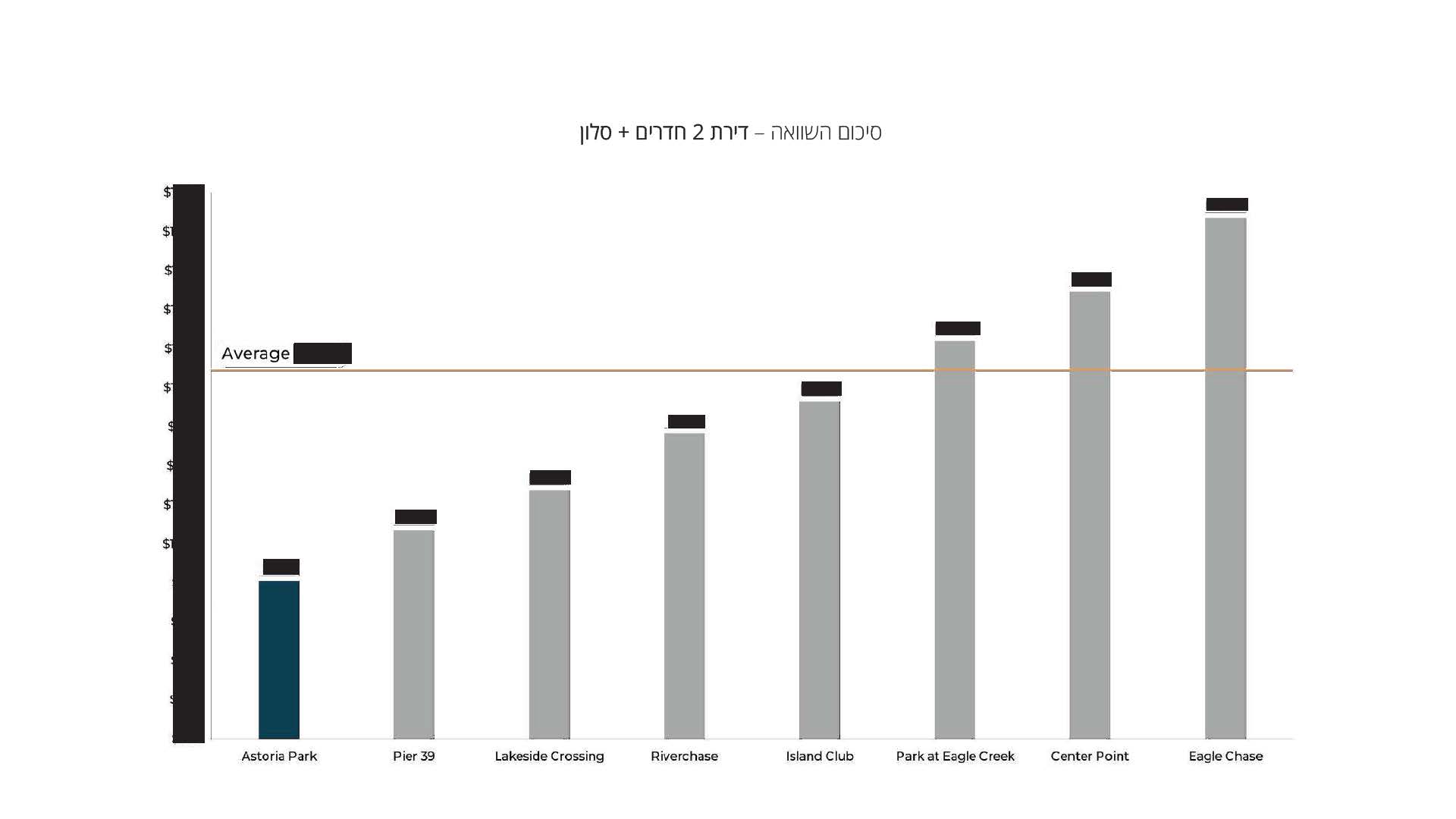

Low rents compared to the market

Our analysis shows a gap of up to $xxx,xxx attributed to the high increase in rents in the area in the last 12 months. The strategy is to catch up with this gap by improving the rental process and of course upgrading the apartments.

improvement

The improvement strategy includes upgrading at least 33% of the apartments, as well as upgrading the common areas and the pool area, the residents' club, playgrounds, signage and courts. Our calculation shows discounts on the rent increase on average of about $xxx per upgraded apartment and a total of $xxx,xxx for NOI (net income) as a result of the improvement operations.

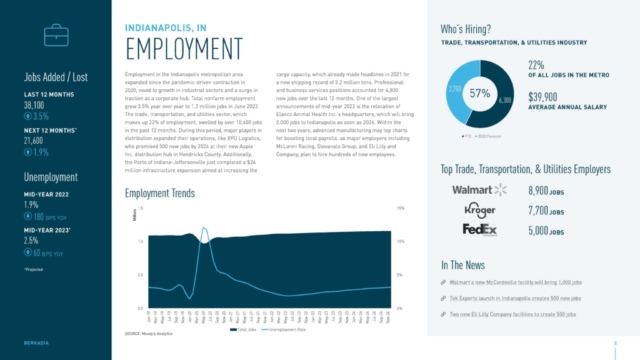

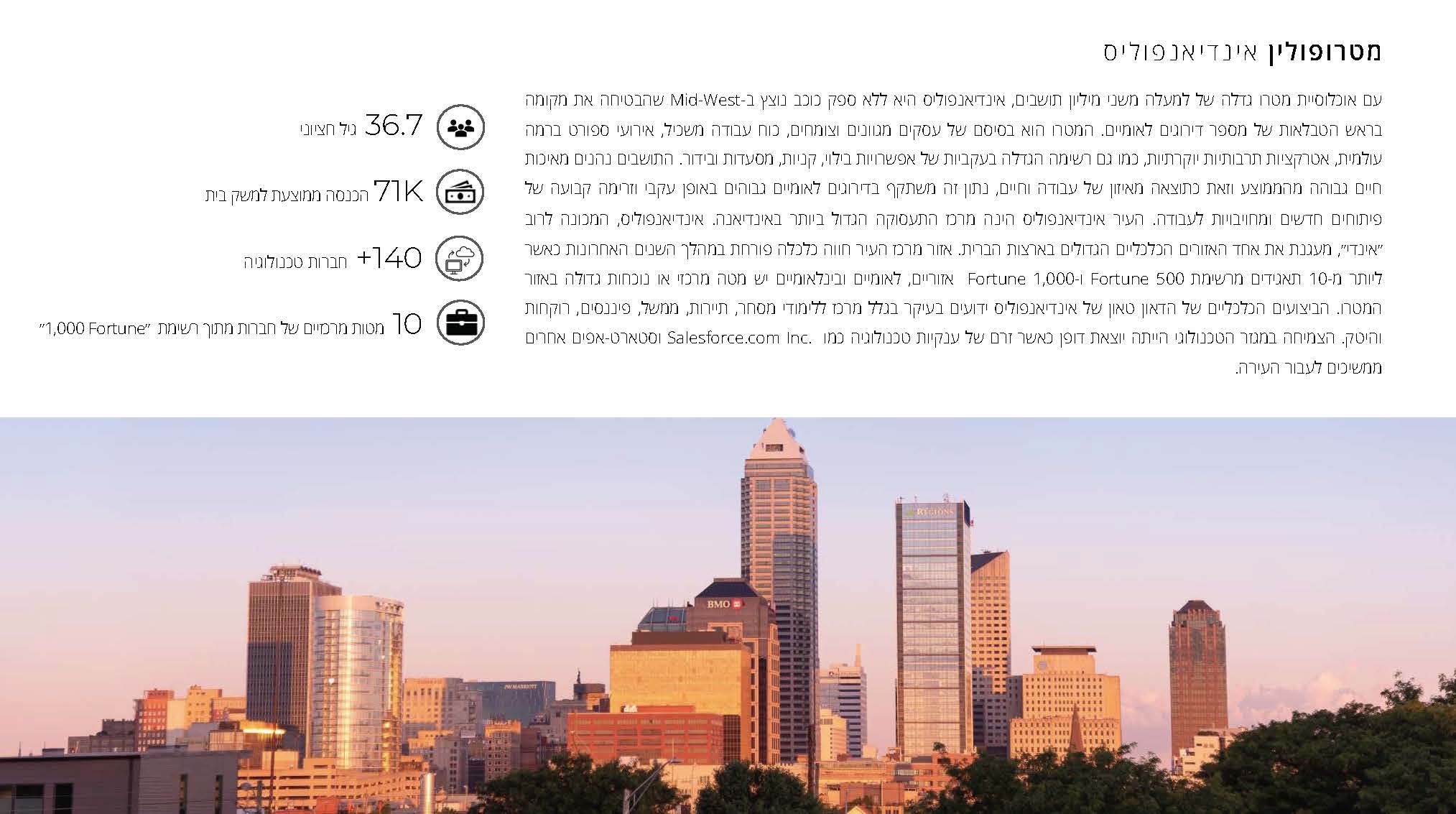

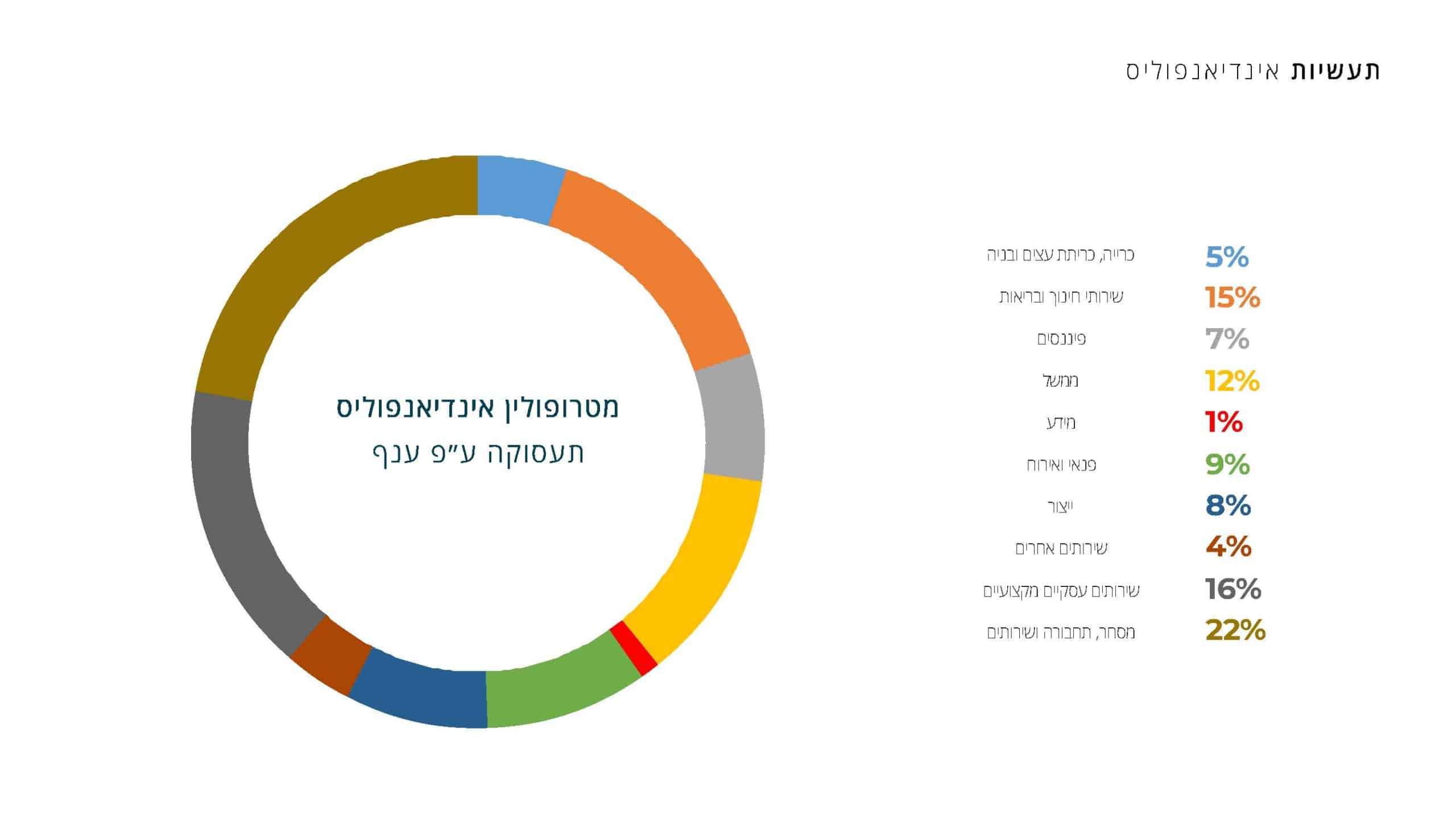

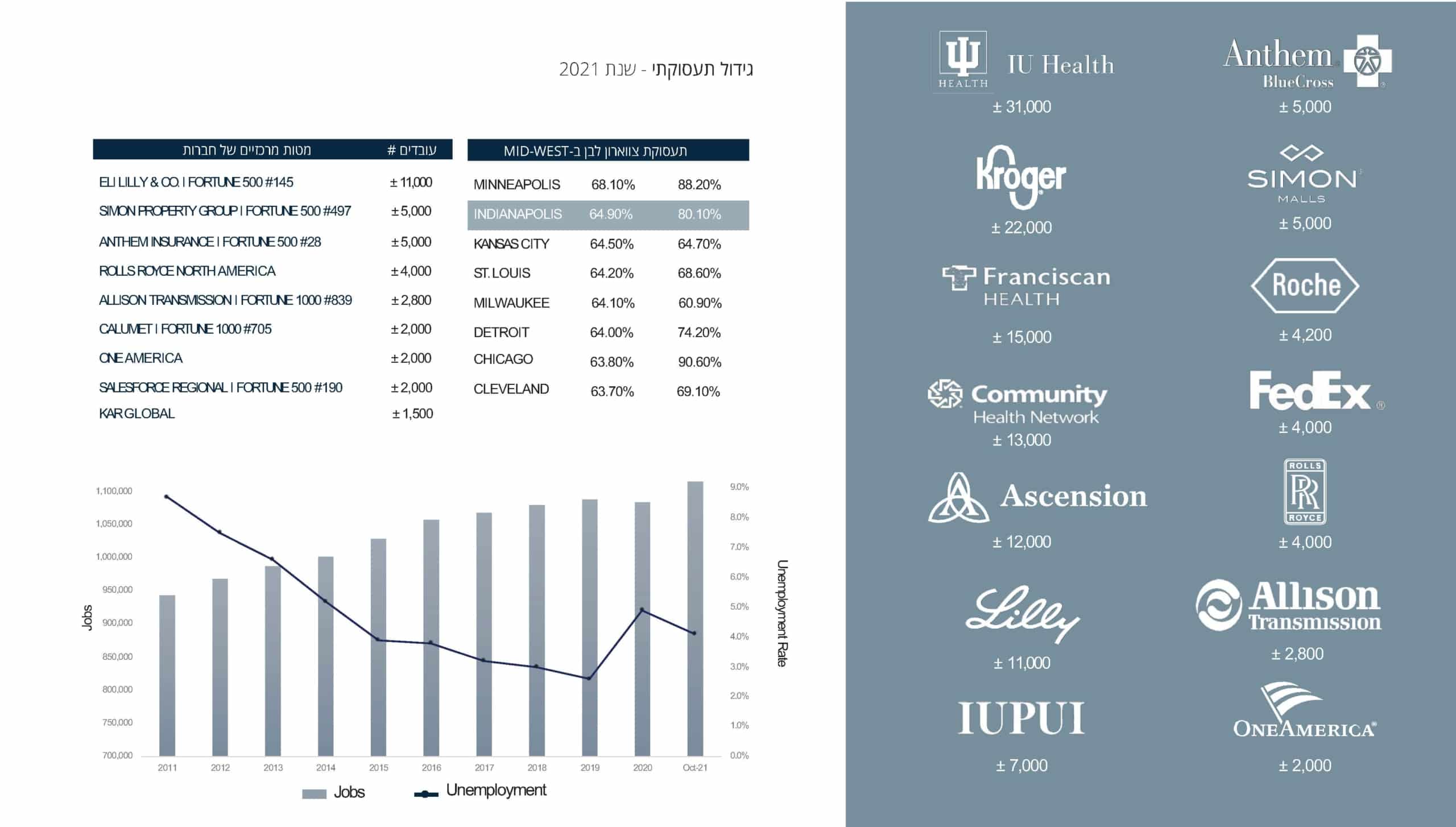

metropolis Indianapolis

With a growing metro population of over two million residents, Indianapolis is undoubtedly a shining star in the Mid-West that has secured its place at the top of several national rankings. The metro is home to diverse and growing businesses, an educated workforce, world-class sporting events, prestigious cultural attractions, as well as an ever-growing list of entertainment, shopping, dining and entertainment options. The residents enjoy a higher than average quality of life as a result of a balance of work and life, this figure is reflected in consistently high national rankings and a constant flow of new developments and work commitments. The city of Indianapolis is the largest employment center in Indiana. Indianapolis, often referred to as "Indy", anchors one of the largest economic areas in the United States. The downtown area has experienced a booming economy over the past few years with more than 10 regional, national and international Fortune 500 and Fortune 1,000 corporations having a major headquarters or presence in the metro area. The economic performance of downtown Indianapolis is best known for its center for commerce, tourism, government, finance, pharmacy and hi-tech studies. Growth in the technology sector has been extraordinary with an influx of tech giants like Salesforce.com Inc. And other startups continue to move to the city.

36.7 median age

71K average household income

140+ technology companies

10 headquarters of companies from the "Fortune1,000" list

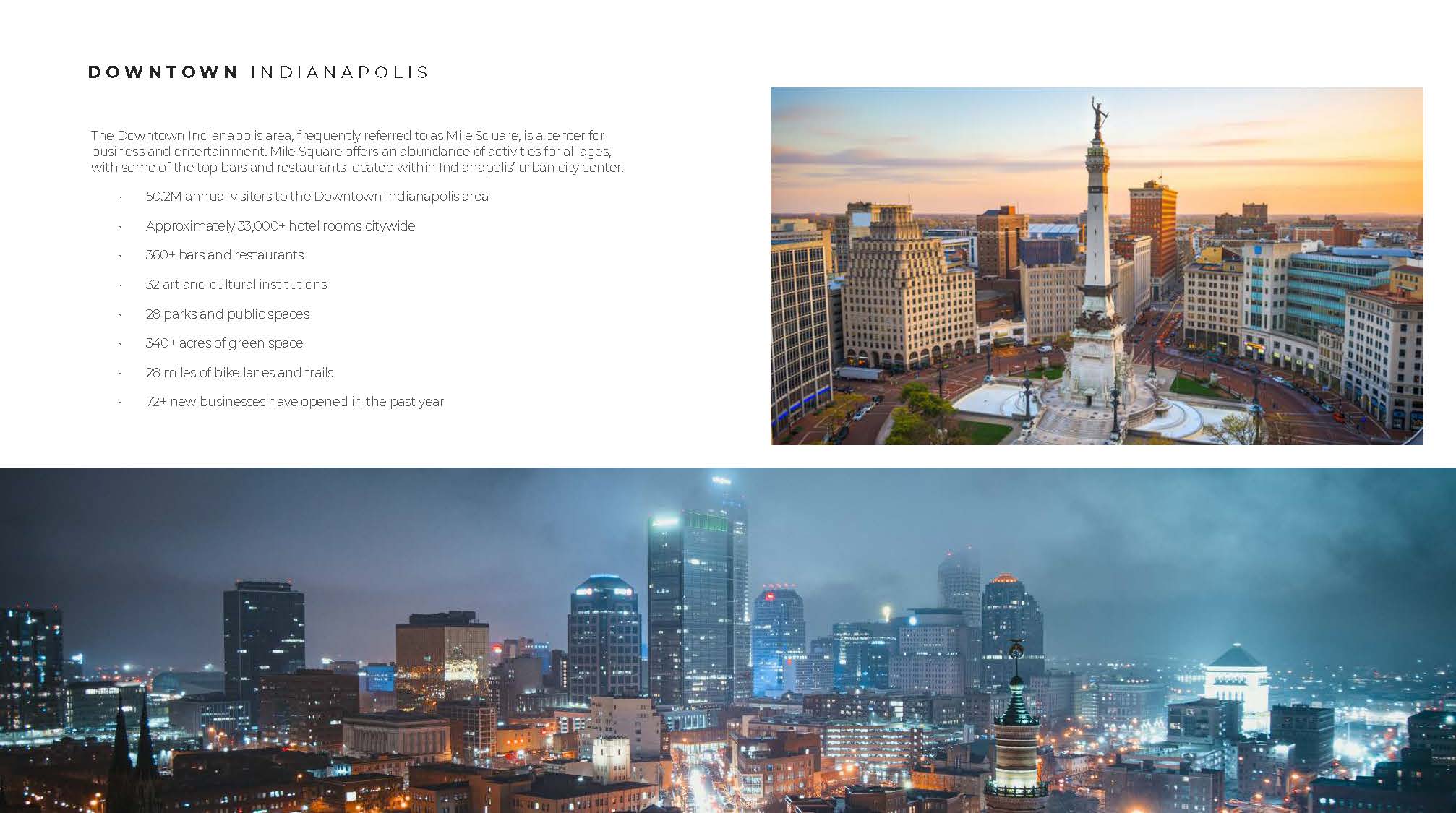

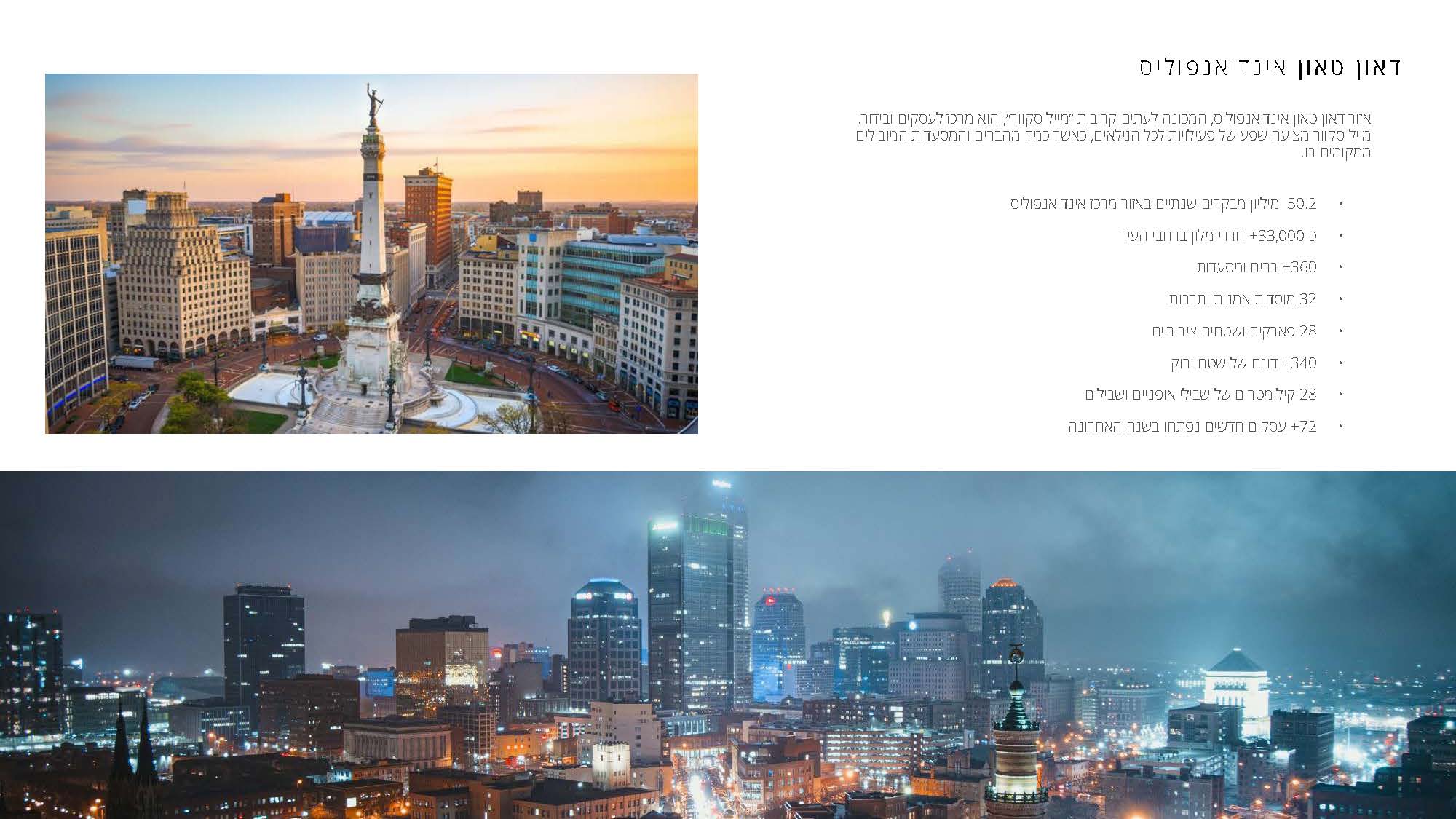

Downtown Indianapolis

The Downtown Indianapolis area, often referred to as the "Square Mile," is a center for business and entertainment. Mile Square offers plenty of activities for all ages, with some of the top bars and restaurants located there.

- 2 million annual visitors to the downtown Indianapolis area

- About 33,000+ hotel rooms throughout the city

- 360+ bars and restaurants

- 32 art and culture institutions

- 28 parks and public areas

- 340+ dunams of green space

- 28 kilometers of bike paths and trails

- 72+ new businesses opened in the last year

The best reasons to invest in Indianapolis

Prime location

Nearly 80% of the state's population can be reached within a day's drive from Indianapolis, which is proving to be a critical feature amid the changing face of retail and logistics.

Strong corporate base

More than 10 regional, national and international Fortune 500 and Fortune 1,000 corporations have headquarters or a major presence in the metro area

Low business costs

Indiana ranks in the top ten states with the best taxation for business owners

Excellent transportation infrastructure

Indianapolis ranks first in highway transit and is known as the "Crossroads of America"; The city has 11 freeways and eight interstate interchanges, more than any other city in the US

Higher education institutions are among the best

More than 20 colleges and universities are within a radius of 110 km from the city, and provide a skilled and high-quality workforce

Rich culture and quality of life

The city attracts a lot of attention for being lively and "sophisticated", as well as culturally rich and welcoming

The big employers in Indianapolis

Indiana University – (IUPUI)

A public university offering undergraduate, graduate and professional studies; Indiana University - Purdue University Indianapolis is a collaboration between the two universities that works to expand the exposure of the two colleges.

- 15,290 jobs

- 24,150 students (fall 2021)

- 92% of students live off campus

- Estimated annual economic impact of $1.8 billion

- 250+ degree programs

- A campus of 590 dunams

INDIANA UNIVERSITY HEALTH

Formerly known as Clarian Health Partners, Indiana University Health employs thousands of people throughout the greater Indianapolis area. that "IU Health" is the largest health system in Indiana, providing the region with hospitals and a workforce of 36,000 employees

SALESFORCE INC.

Salesforce is housed in a building known as the Salesforce Tower Indy, a 48-story office building that is the tallest building in the state of Indiana.

23,190 jobs throughout the metro

- Office building with a size of 84,000 square meters

- Regional headquarters in Indianapolis

- Salesforce plans to invest over $40 million over the next 10 years

ESKENAZI HEALTH

Eskenazi Health operates Sidney & Lois Eskenazi Hospital, the medical group's flagship hospital and the home of the oldest public health system in the state of Indiana.

- 4,620 employees throughout the city

» A medical facility with a size of about 120 dunams

ROUDEBUSH VA MEDICAL CENTER

The Richard L. Roudebush VA Medical Center is a veterans hospital located in Indianapolis and serves as the flagship of the entire Indiana Veterans Health System

- 3,040 employees

- The size of the center is about 185 dunams

- » 50 buildings on campus

coordinator - FEDEX EXPRESS INDIANAPOLIS

First opened in 1988, FedEx Express Indianapolis employs approximately 5,000 people throughout the city, making it the second largest cargo facility in the entire world

- 5,000 jobs throughout the city

- The facility is about 223 dunams

- FedEx sorts 99,000 packages an hour

- The second largest FedEx hub in the world

» FedEx plans to invest $1.5 billion over the next seven years to expand facilities

Huge developments:

Down ELANCO GLOBAL

Elanco Animal Health Inc. broke ground on a new global headquarters, taking over what used to be a General Motors bio plant. The project is estimated to cost over 700 million dollars, and brings about 1,000 new jobs to the city.

$700M investment

- Creating 1,000 new jobs

- The headquarters facility will focus on laboratory/research

- Estimated completion: end of 2022

renovation GAINBRIDGE FIELDHOUSE

Often known as Bankers Life Fieldhouse, Gainbridge House is the home of the National Basketball Association's Indiana Pacers. The complex is undergoing a major renovation, at an estimated cost of over 300 million dollars.

- A $362 million renovation

- The works started at the beginning of 2020

- Estimated completion: end of 2022

Expansion of the conference center

- A $725 million expansion approved by the Indy City Council in fall 2020

- Two hotels (financed separately through private financing)

- 800 rooms

- Estimated completion: 2024

- Hotel No. 2

- 600 rooms

- Construction start date is planned for 2026

BOTTLEWORKS DISTRICT

Encompassing a 48.5-acre site at the former Coca-Cola bottling plant, and serving as its transportation hub, the Bottleworks District project represents Indianapolis' newest mixed-use neighborhood. Located at the north end of Massachusetts Avenue, the plan calls for apartments, 146 hotel rooms (West Elm), shops, a movie theater, office space and dining complexes.

- A $300 million mixed-use project (residential + commercial)

- 72 dunams of office space

- 3 dunams of commercial space

- 7 dunams of food complexes to be called "The Garage"

- The luxury hotel and garage were completed in 2020

- The development will be completed in 2023

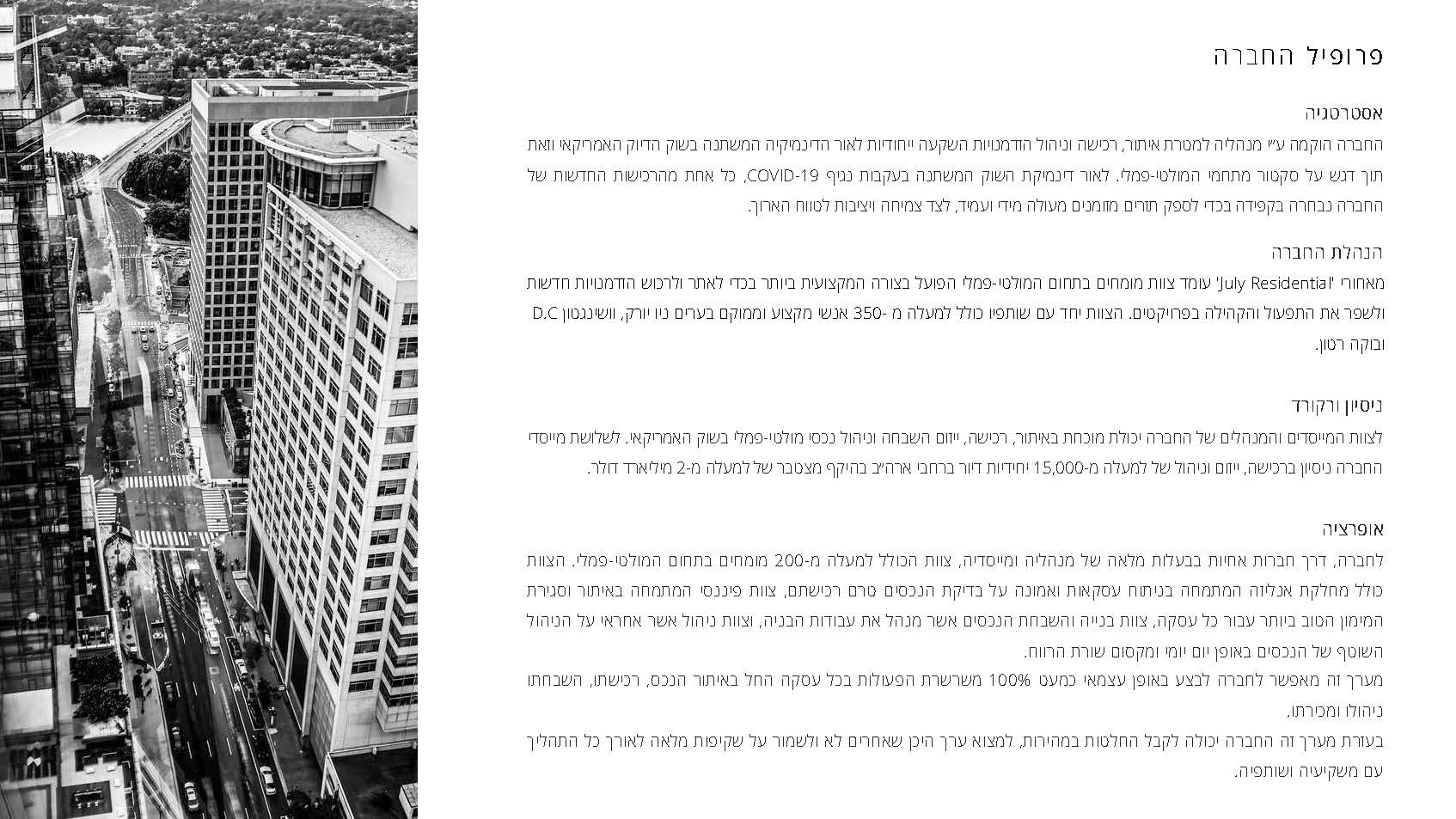

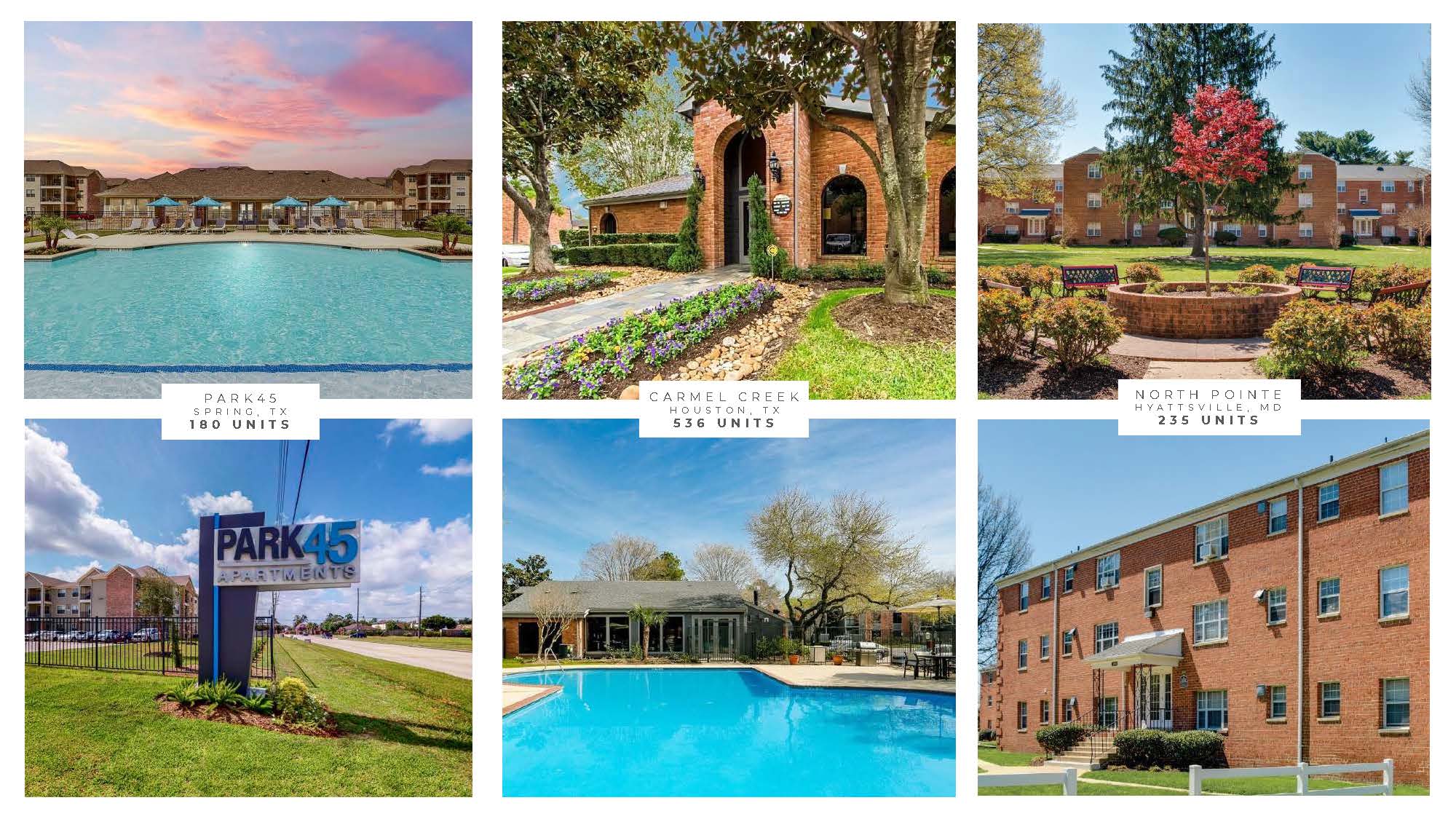

company profile:

strategy

The company was established by its directors for the purpose of locating, purchasing and managing unique investment opportunities in light of the changing dynamics in the American precision market, with an emphasis on the multi-family complex sector. In light of the changing market dynamics following the COVID-19 virus, each of the company's new acquisitions has been carefully selected to provide excellent and durable cash flow, along with long-term growth and stability.

Company management

Behind 'July Residential' is a team of experts in the multi-family field who work in the most professional manner to locate and acquire new opportunities and improve operations and the community in the projects. The team together with its partners includes over 350 professionals and is located in the cities of New York, Washington DC and Boca Raton.

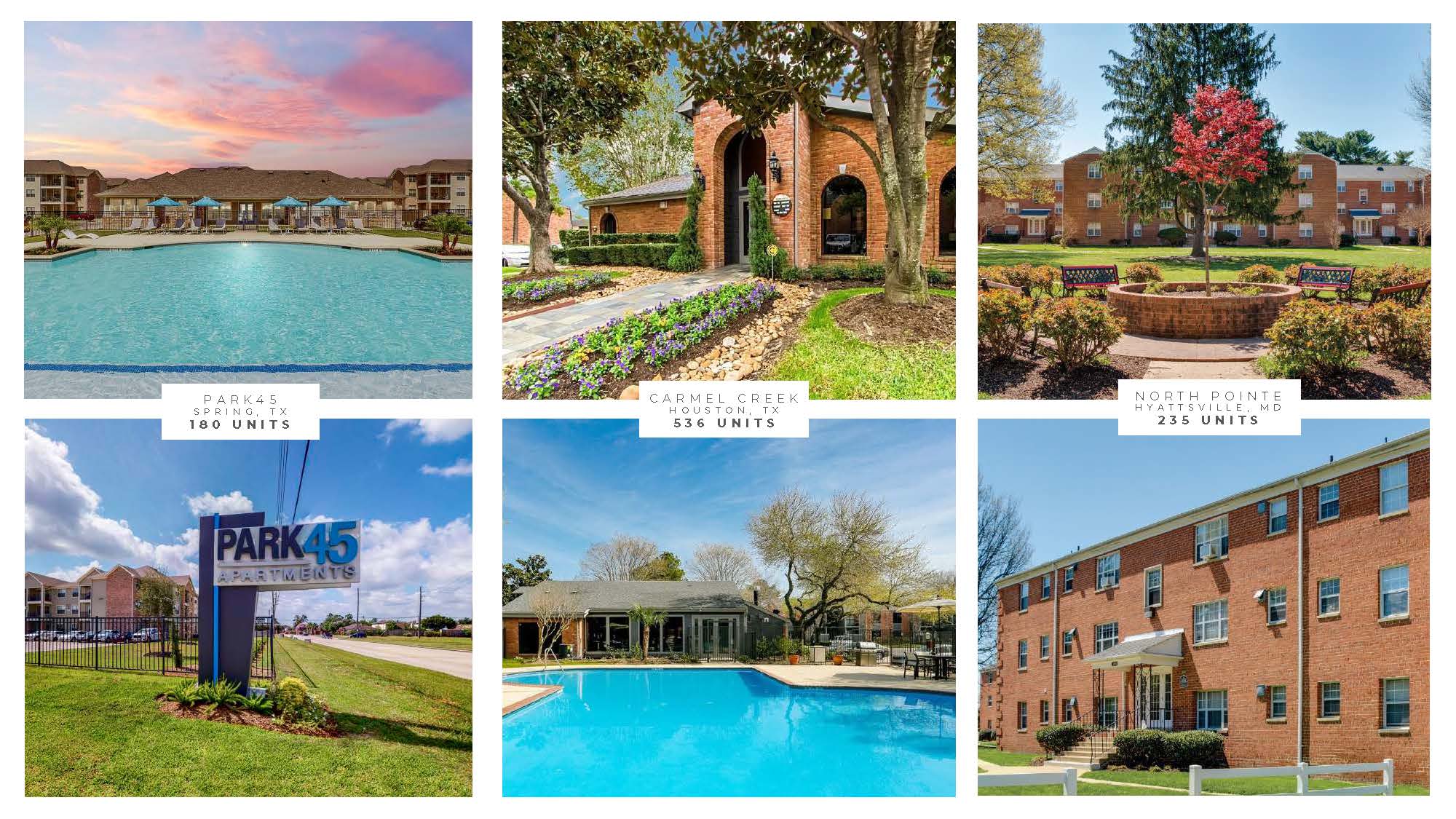

Experience and track record

The team of founders and managers of the company has a proven ability in locating, purchasing, initiating improvements and managing multi-family properties in the American market. The three founders of the company have experience in the purchase, initiation and management of over 15,000 housing units throughout the US with a cumulative volume of over 2 billion dollars.

operation

The company, through sister companies fully owned by its managers and founders, has a team that includes over 200 experts in the multi-family field. The team includes an analysis department that specializes in analyzing transactions and believes in inspecting the properties before purchasing them, a financial team that specializes in locating and closing the best financing for each transaction, a construction and property improvement team that manages the construction works, and a management team that is responsible for the day-to-day management of the properties and maximizing line the profit

This setup allows the company to independently carry out almost 100% of the chain of operations in each transaction, starting with locating the property, purchasing it, improving it, managing it and selling it.

With the help of this system, the company can make decisions quickly, find value where others do not and maintain complete transparency throughout the process with its investors and partners.

Management July Residential

Roberto "LV" Lavallee

One of the founders of the company, with over 20 years of experience, LV manages and supervises the ongoing management of all assets, including supervision of the initial analysis process prior to the purchase of the assets, management of the financial system, strategy and budgets of each of the assets under the company's management. L.V. serves in his second hat as the chairman of the management company Element National Management, which manages over 12,000 units across the USA.

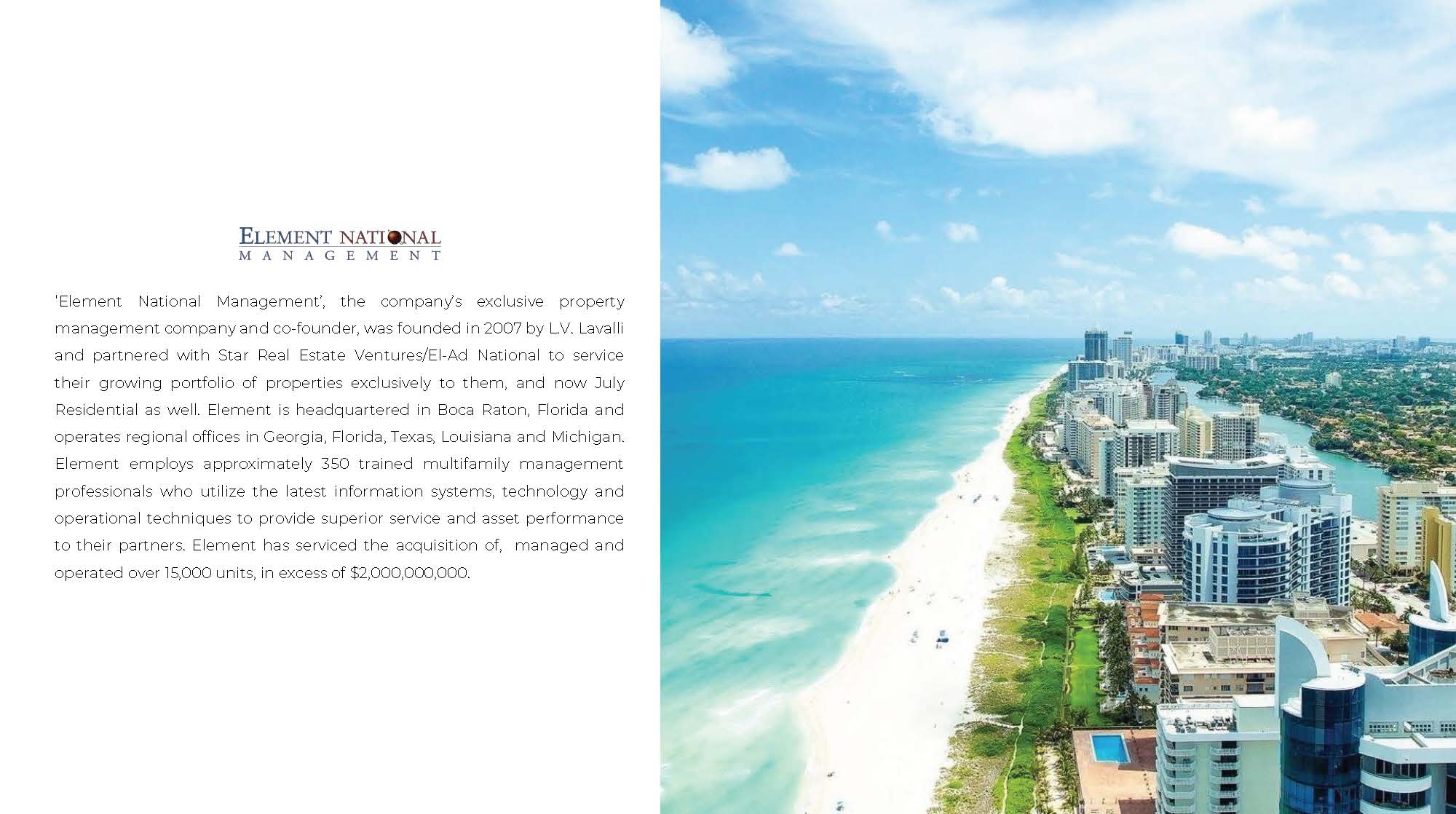

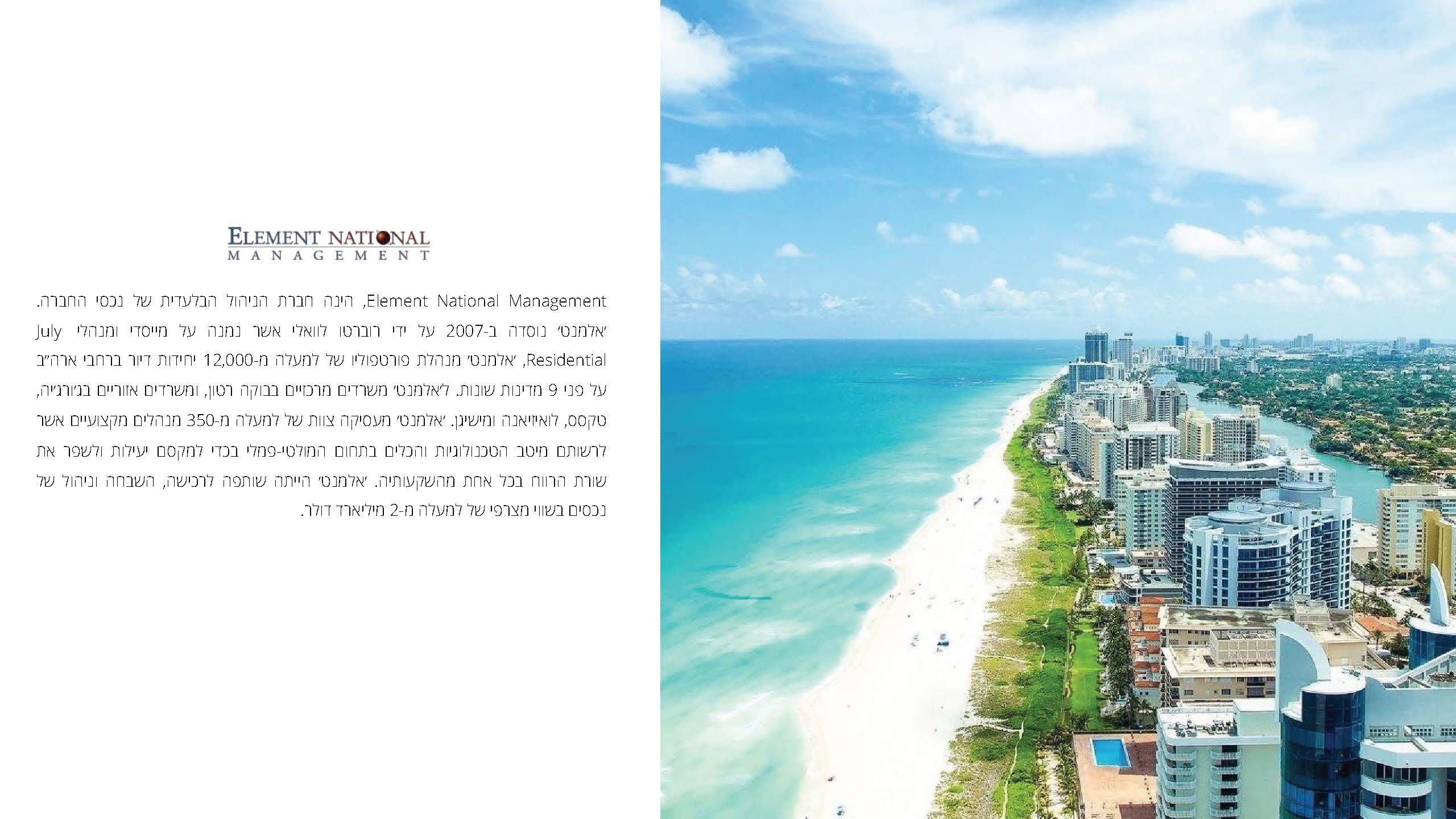

Element National Management:

is the exclusive management company of the company's assets. "Element" was founded in 2007 by Roberto Lavallee who is one of the founders and managers of July Residential, "Element" manages a portfolio of over 12,000 housing units throughout the US across 9 different countries. Element has central offices in Boca Raton, and regional offices in Georgia, Texas, Louisiana and Michigan. Element employs a team of over 350 professional managers who have at their disposal the best technologies and tools in the multi-family field in order to maximize efficiency and improve the profit line in each of its investments. Element was a partner in the purchase, improvement and management of properties with an aggregate value of over 2 billion dollars.

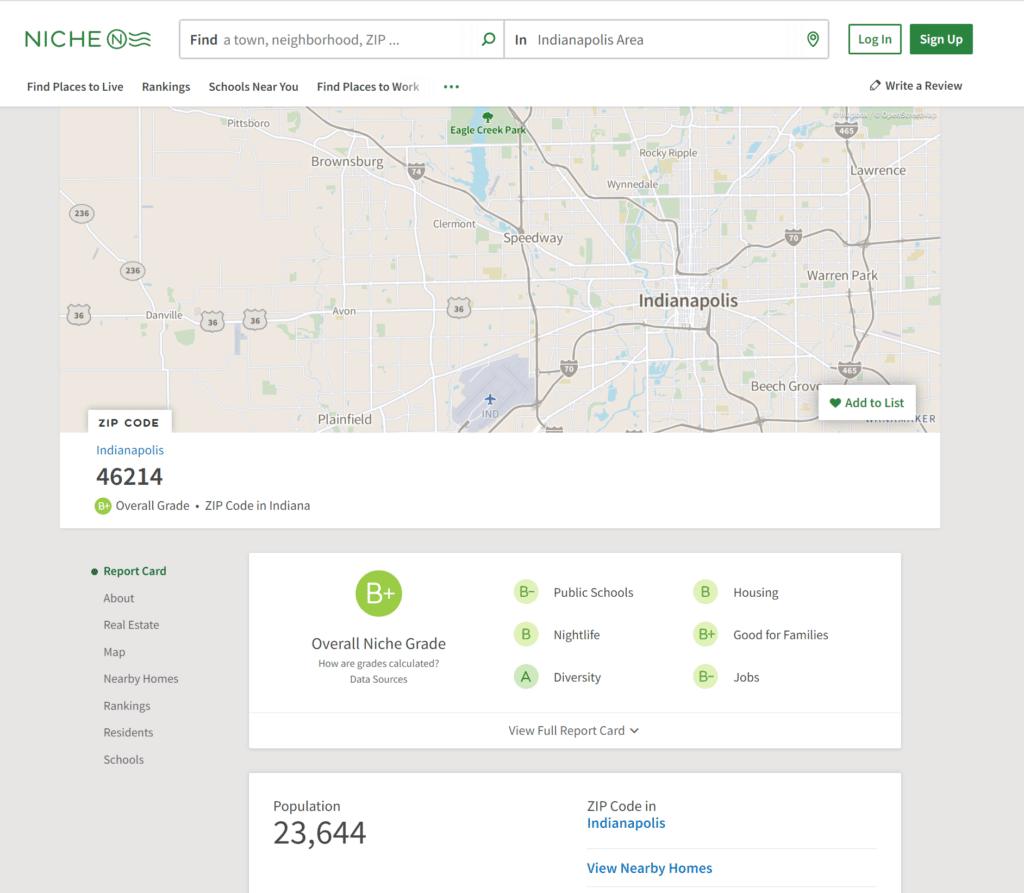

The ranking of the area according to the Niche website

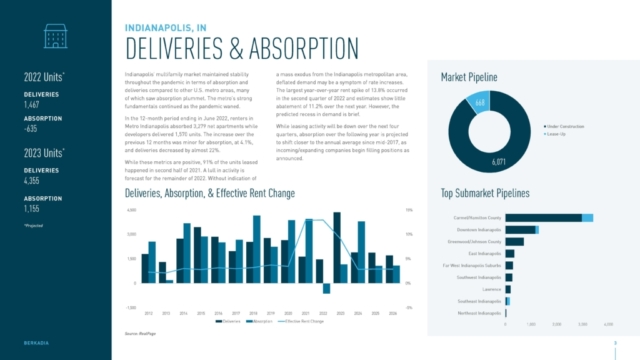

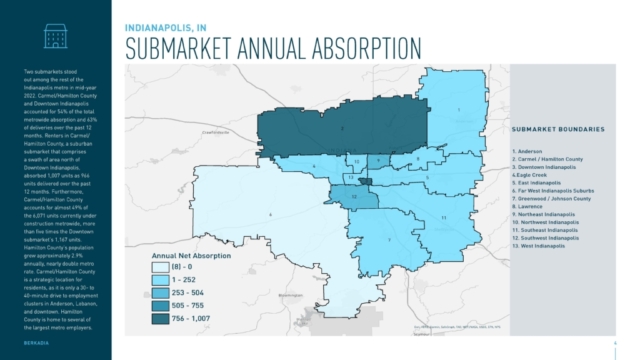

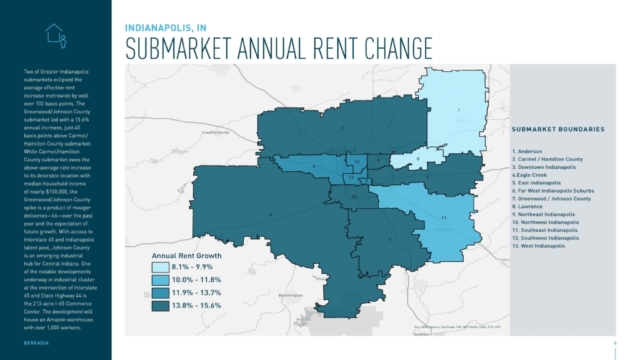

Berkadia Mid Year 2022 Report Indianapolis

Property Documents

Details

Updated on September 12, 2022 at 5:52 am- Price: $100,000

- Rooms: 470

- Bathrooms: 470

- Property Type: Apartment, Community, Condo, Multi Family Property

Address

Open on Google Maps- City Indianapolis

- State / County Indiana

- Reserved Aspen Ridge

Mortgage Calculator

- Down Payment

- Loan amount

- Monthly Mortgage Payment

- Property Tax

- Home insurance

- SMEs

- Monthly HOA Fees

Video

Schedule a Tour

Similar Listings

Contact Information

View listings- Lior Lustig

- 9786008229